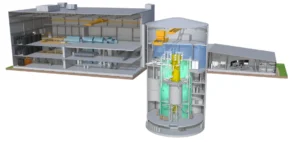

The British government officially announced this Tuesday a significant public investment of £14.2 billion (almost €17 billion) for the Sizewell C nuclear power plant project, spearheaded by the French energy company EDF. This funding aims to accelerate the construction of two European Pressurized Reactors (EPR), each with an estimated capacity of 1.6 gigawatts (GW). Although the announcement is substantial, the final investment decision (FID) is expected to be made at the beginning of July during a bilateral summit planned between France and the United Kingdom. The total estimated cost of the project, according to various assessments, could rise to £30 billion.

Major Investment in Energy Security

This decision forms part of a broader strategy intended to enhance the UK’s energy security in response to disruptions observed since the outbreak of the conflict in Ukraine. Initially developed with participation from the China General Nuclear Power Group (CGN), the project evolved toward a structure dominated by the British government, which now holds a majority stake. EDF Energy, EDF’s British subsidiary, retains a central role in managing the project and the site’s future operations. According to official statements, Sizewell C is expected to generate enough electricity to supply approximately six million British homes upon completion.

Reaffirmed Nuclear Strategy

Since the change of government in July, with the Labour Party coming into power, the UK’s nuclear strategy has remained consistent, reaffirming its intention to actively revive this energy sector. The current government even foresees a “golden age of nuclear,” illustrated by additional investments, notably £2.5 billion over five years in nuclear fusion research. These measures are part of the broader UK public investment plan, globally valued at £113 billion, also including Small Modular Reactors (SMRs).

Cost and Consumer Financing

However, the project raises significant economic questions regarding its real cost, considered high by several British financial analysts. According to official forecasts, public funding for Sizewell C will be partially passed on through British consumers’ energy bills, which could see a moderate but sustained increase. This financing mechanism aims to ensure a consistent flow of liquidity, crucial for the project’s realization over several decades. The construction phase, expected to last about ten years, could generate around 10,000 direct and indirect jobs, thereby contributing to regional economic development.

This major decision, although supported by numerous industrial stakeholders, will attract close attention from the European energy market due to its long-term financial and technological implications.