The British government has confirmed the inclusion of CO2 removal credits in its emissions trading system (UK ETS) from 2029, marking a significant step in the country’s climate strategy. This decision, announced in July 2025, aims to create a strong demand signal for carbon capture and storage projects, but faces major challenges in terms of price and availability.

A Considerable Price Gap Between Removals and Allowances

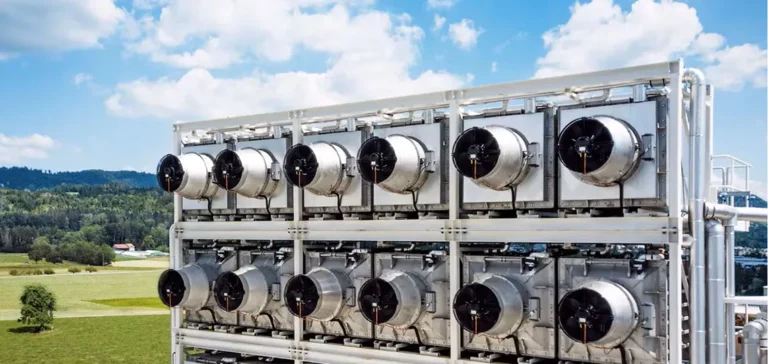

Removal credits based on Bioenergy with Carbon Capture and Storage (BECCS) and Direct Air Capture (DAC) technologies currently trade around 300 US dollars per tonne, creating a substantial gap with UK Allowances prices. This price difference raises questions about the economic attractiveness for market participants who will have to choose between buying traditional allowances or investing in more expensive removal credits.

The “one-in-one-out” principle adopted by the UK ETS Authority means that for each removal credit introduced, one emission allowance will be withdrawn from the market. This approach aims to maintain the integrity of the price signal while preserving the system’s overall emissions cap.

Limited Supply Facing Future Needs

Current supply of removal credits remains extremely limited. The Puro.Earth registry, one of the main certification platforms, has issued only 67,286 credits to date in the United Kingdom. Market analysts estimate that an annual supply of more than 1.5 million credits would be necessary to have a significant impact on the UK ETS market.

Projects must demonstrate a carbon storage capacity of at least 200 years to be eligible, a requirement that allows the inclusion of technologies like biochar but maintains high permanence standards. This storage duration represents a compromise between the need for long-term sequestration and the scalability of available solutions.

Uncertainty Around Forest Credits

The decision regarding the inclusion of Woodland Carbon Code credits remains pending. These units, which traded at a weighted average price of 26.85 pounds sterling per tonne of CO2 equivalent in 2024, could considerably increase available supply. The Woodland Carbon Code has issued 12,300 ex-post credits and 12,153,000 ex-ante credits, suggesting significant scaling potential, although these ex-ante credits generally have a delivery timeframe of over 50 years.

The UK ETS Authority has received evidence suggesting a strong case for integrating forest removals, but concerns persist regarding permanence, price impact, and unintended consequences on land use. An additional technical consultation is planned to refine implementation details, including buffer pool contribution rates and auction structures.

Auction Mechanisms Under Development

The UK ETS Authority has confirmed its intention to provide auctions to facilitate market access for removal operators. These auctions could take the form of mixed product auctions, allowing participants to bid on different types of credits in a single auction. This approach aims to reduce barriers to entry, particularly for smaller operators, and to send a direct demand signal that could help unlock financing for large UK-based projects.

The British government has also mandated the British Standards Institution to develop a UK GGR (Greenhouse Gas Removal) standard, with minimum quality thresholds to be published in 2025. This regulatory framework will be essential to ensure the credibility and integrity of removal credits integrated into the system.

Market participants are closely watching these developments, recognizing that successful integration of removals into the UK ETS could create an important precedent for other carbon compliance markets. The balance between maintaining environmental integrity, ensuring economic viability, and stimulating technological innovation remains the central challenge as the United Kingdom prepares for this major transition in its carbon market.