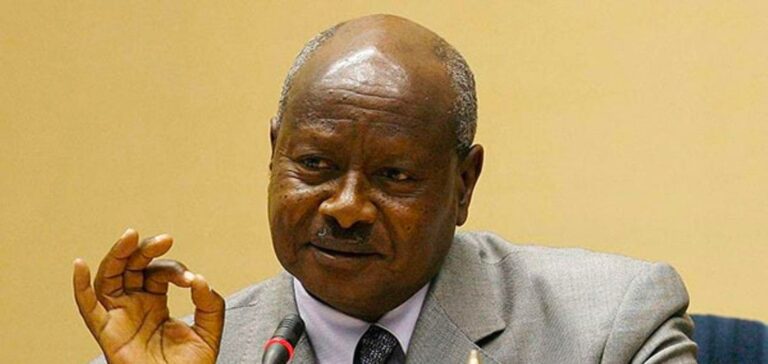

Ugandan President Yoweri Museveni said Friday that he would go ahead with the planned oil megaproject with French group TotalEnergies despite a European Parliament resolution criticizing its “human rights violations” against opponents.

The project “will continue as stipulated in the contract we have with TotalEnergies and (Chinese oil giant) CNOOC,” Museveni said on Twitter.

“TotalEnergies convinced me of the pipeline idea; if they choose to listen to the European Parliament, we will find another partner to work with,” he added.

“In any case, our oil will be extracted in 2025 as planned. So the people of Uganda need not worry,” he stressed.

Lori Museveni, who has ruled Uganda with an iron fist since 1986, has praised the project in the past, citing in particular the economic benefits for this landlocked country where the majority of the population lives below the poverty line.

Earlier in the day, the Ugandan Parliament had strongly denounced the resolution adopted on Thursday by MEPs and condemning the mega-project.

“These are projects that have been approved by the Parliament of Uganda, the parliament of a sovereign country, and anything that goes against it is an affront to the independence of this house and we cannot take it lightly,” reacted the deputy speaker of parliament, Thomas Tayebwa, in a statement.

In February, TotalEnergies announced a $10 billion investment agreement with Uganda, Tanzania and CNOOC, including the construction of a pipeline of more than 1,400 kilometers linking the Lake Albert oil fields in western Uganda to the Tanzanian coast.

In a non-binding resolution, the European Parliament said it was “extremely concerned about human rights violations” in both countries, citing “arrests, intimidation and judicial harassment of human rights defenders and non-governmental organizations.

Estimating that more than 100,000 people are likely to be displaced along the pipeline route, MEPs called for “adequate compensation for those expropriated”.

In addition, the European Parliament is asking TotalEnergies to delay the project for a year in order to study “the feasibility of an alternative route that better protects the protected and sensitive ecosystems and water resources of Uganda and Tanzania.

Juliette Renaud, Campaigner at Friends of the Earth France, said the resolution sent “a strong political signal against Total’s Tilenga and EACOP projects, whose human, environmental and climate costs are undeniable and simply unacceptable.

TotalEnergies said on Thursday that it was “doing everything possible to make this an exemplary project in terms of transparency, shared prosperity, economic and social progress, sustainable development, environmental awareness and respect for human rights.

Under the waters and on the shores of Lake Albert, a 160 km natural barrier separating Uganda from the Democratic Republic of Congo, lies the equivalent of 6.5 billion barrels of crude oil, of which about 1.4 billion barrels are recoverable in the current state of discovery.

Uganda’s reserves can last between 25 and 30 years with an estimated peak production of 230,000 barrels per day.