The growing demand for natural gas in the United States is now significantly exceeding domestic production capacity. According to a recent report by the U.S. Energy Information Administration (EIA), this dynamic is pushing natural gas prices notably higher for the coming years compared to 2024 levels.

Supply Pressure and Price Surge

The EIA anticipates average natural gas prices at Henry Hub will reach $4.02 per million British Thermal Units (MMBtu) in 2025 and $4.88/MMBtu in 2026. In 2024, the average price was just $2.19/MMBtu. This rise reflects a combined increase in domestic consumption and exports estimated at nearly 4 billion cubic feet per day (Bcf/d), while U.S. production will grow by less than 3 Bcf/d.

Although gas inventories have recently risen above their five-year average, the EIA expects a quick reversal of this trend by October. This scenario would result in inventories dropping below their five-year average, placing additional upward pressure on prices.

Contrasting Production Trends

Total natural gas production is expected to reach 115.9 Bcf/d in 2025, according to the updated EIA forecasts, marking a slight increase from previous estimates. However, projections for 2026 have been revised downward to 116.3 Bcf/d, a reduction of 700 million cubic feet per day (MMcf/d) from previous estimates.

This decline is primarily attributed to an anticipated reduction in drilling activity in key hydrocarbon-producing basins, notably the Eagle Ford and Permian basins. Low oil prices are also contributing to a slowdown in associated natural gas production, which is significant in these regions traditionally focused on crude oil.

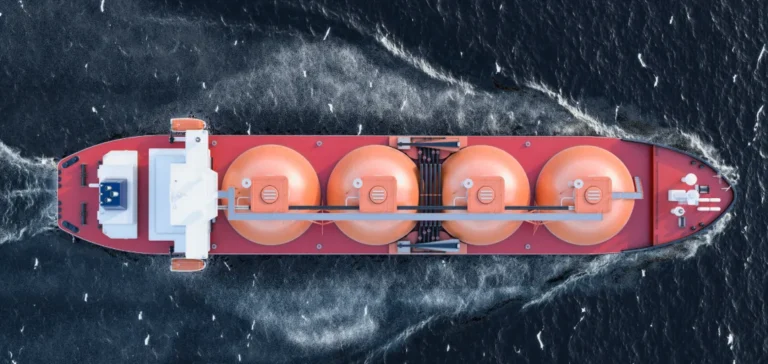

Rapid Growth in Exports

The liquefied natural gas (LNG) export sector plays a central role in this upward price dynamic. After averaging 11.9 Bcf/d in 2024, LNG exports are expected to rise to 14.6 Bcf/d in 2025 and reach 16 Bcf/d in 2026. Several new infrastructure projects reinforce this trend, notably the Golden Pass LNG liquefaction terminal jointly developed by ExxonMobil and QatarEnergy, scheduled for startup by late 2025.

This growth in exports comes as existing terminal capacities continue to expand. The recent partial commissioning of the Plaquemines LNG terminal, owned by Venture Global LNG in Louisiana, and the mid-scale expansion of Corpus Christi LNG by Cheniere Energy in Texas have already contributed to record-high LNG demand this past spring.

Power Sector Consumption and Regional Impact

In response to anticipated higher gas prices, gas consumption in the power sector is expected to decline by 3% this summer compared to last year. The EIA forecasts the average price of gas delivered to power plants between June and September will be approximately $3.84/MMBtu, a substantial increase of $1.39 compared to the previous year.

Nevertheless, overall electricity demand growth in the U.S., driven primarily by commercial and industrial sectors, including data centers and manufacturing industries, is expected to result in a 1% increase in national power generation this summer. Despite this increase, the share of natural gas in the energy mix is projected to decline, while solar generation will increase by 33%, and hydropower by 6%, responding to favorable climatic conditions in the western U.S.