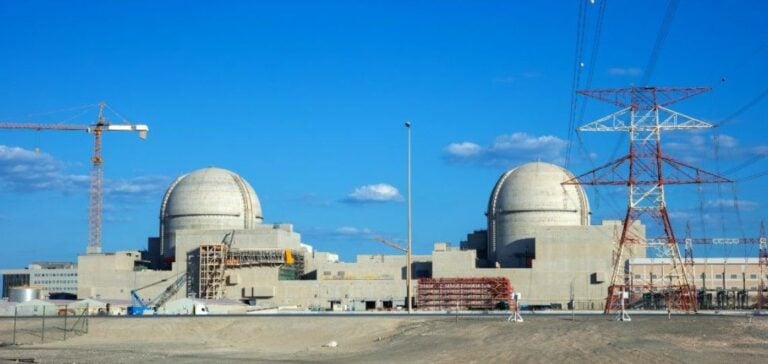

The United Arab Emirates, one of the world’s leading oil producers, is seeking to diversify its energy mix by integrating more low-carbon energy sources. After the commercial commissioning of their first nuclear power plant in 2021 , followed by a second reactor in 2022, the government is evaluating the construction of a second facility to meet the country’s growing electricity demand.

With a population of nearly 10 million and a growing industry, the United Arab Emirates sees nuclear power as a viable and sustainable solution for securing its future energy supply. The transition to cleaner energy sources is also seen as a way of attracting more foreign investment.

Economic considerations and challenges

The project for a second nuclear power plant would represent an investment of several tens of billions of dollars. Countries such as China, Russia and the USA could submit bids to build the new facility. According to Hamad Alkaabi, UAE Ambassador to Austria and Permanent Representative to theInternational Atomic Energy Agency (IAEA), the government is actively evaluating this option, although no final decision has yet been taken.

Demand for electricity is set to increase substantially over the next ten years, driven by population growth and industrial development. The government has not yet set a precise budget for the new plant, nor decided on its size or location. However, it is possible that an invitation to tender will be issued as early as this year.

Partnership and technology analysis

The new plant could comprise two to four reactors, depending on the technology chosen. Alkaabi points out that the selection process for bidders will be open to all, with no particular favoritism for Korea Electric Power Corporation (KEPCO), which built the first plant. KEPCO won a $20 billion contract in 2009 to design, build and operate four reactors in western Abu Dhabi, near the Saudi border.

Discussions with leading nuclear technology developers are underway, but no specific names have been disclosed. The United Arab Emirates, a close security partner of the United States, signed a nuclear cooperation agreement with Washington in 2009, stipulating that its nuclear program is peaceful and intended solely for energy purposes.

Regional and geopolitical perspectives

Located close to Iran and Saudi Arabia, the United Arab Emirates operate in a complex geopolitical context. While Iran claims to need atomic energy for civilian purposes, the United States accuses it of seeking to develop nuclear weapons. Saudi Arabia, for its part, is in talks with the United States to develop its own civil nuclear program.

The Emirates are committed to purchasing the fuel needed for their reactors on the international market, thus avoiding domestic uranium enrichment and reducing the risks of nuclear proliferation. This strategy is designed to ensure that their program remains exclusively focused on energy production, and to avoid any ambiguity about their intentions.

As discussions and assessments continue, there is considerable interest in the prospect of the UAE strengthening its nuclear infrastructure. This could position the country as a regional leader in sustainable energy technologies, while meeting its growing electricity needs.