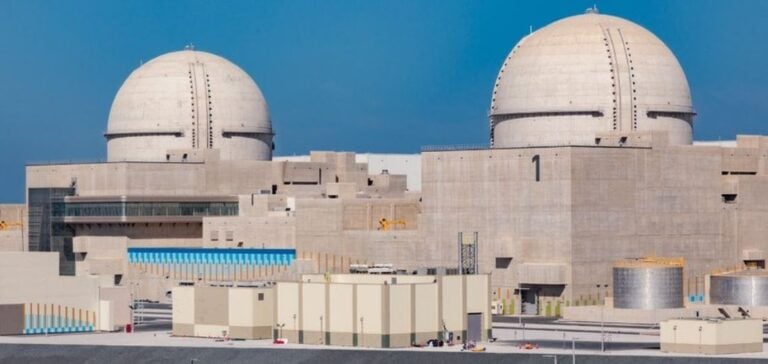

The Barakah nuclear power plant, located to the west of Abu Dhabi, becomes the first nuclear facility in the Arab world to reach full operational status.

Emirates Nuclear Energy Corporation (ENEC) announces that the plant’s four reactors are now in operation, producing 40 terawatt-hours of electricity per year, which covers around a quarter of the United Arab Emirates’ electricity needs.

This development marks a strategic step forward for a country seeking to diversify its energy sources beyond oil and natural gas.

An energy diversification project in full expansion

Despite its dominant position as an oil exporter, the United Arab Emirates is stepping up its efforts to integrate alternative energy sources into its energy mix.

Construction of the Barakah power plant, which began in 2012 at an estimated cost of $24.4 billion, is part of this strategy.

The gradual commissioning of the reactors, from 2020 to 2024, meets the Emirates’ desire to stabilize their power grid and reduce their dependence on hydrocarbons, while promoting stable economic growth.

Barakah is not just a symbolic project.

Its contribution is essential to the country’s electricity supply, particularly in areas of high consumption.

The development of civil nuclear power in the Emirates is also a strong political signal in a region where energy is often associated with strategic and geopolitical issues.

Impact on local industry and economic implications

The energy produced at Barakah directly serves major local industries, including the Abu Dhabi National Oil Company (ADNOC), as well as companies such as Emirates Steel and Emirates Global Aluminium.

The supply of nuclear power enables these entities to stabilize their energy costs, a crucial factor in a volatile market environment.

By integrating nuclear energy into their value chains, these companies reduce their dependence on fossil fuels and secure part of their operations for the long term.

Centralizing energy supply in Barakah also frees up additional capacity for other growing economic sectors.

This redirection of energy resources can support new industrial projects and foreign investment, consolidating the Emirates’ position as a regional economic hub.

Towards a more balanced energy future in the Middle East

Barakah’s success could influence other countries in the region, such as Saudi Arabia, which is also considering developing its own civil nuclear program.

The Emirates’ decision to commit fully to nuclear power is a demonstration of their ability to navigate between energy challenges and international political constraints, while respecting the security and non-proliferation standards imposed by international agreements.

The Emirates’ energy prospects, through the diversification and modernization of their infrastructures, indicate a determination to maintain a competitive edge in a constantly evolving global energy market.

The full commissioning of Barakah represents a centerpiece of this strategy, offering a potential model for other Middle Eastern countries seeking to balance their energy needs with economic and security considerations.