The market for solar applications is evolving rapidly, propelled by increased demand for solar installations and ongoing technological advances.

These digital tools play a crucial role in optimizing the design, management and maintenance of photovoltaic systems, but also in other energy sectors, increasing their efficiency and profitability.

Market context and growth

In 2023, the global market for solar energy software solutions will be worth 895.60 million USD.

With growth projected at a compound annual growth rate of 8.5%, this market is expected to reach 1.67 billion USD by 2031.

This growth is fuelled by government initiatives to promote renewable energies, ambitious sustainability targets, and increasing adoption of solar installations in the residential and industrial sectors.

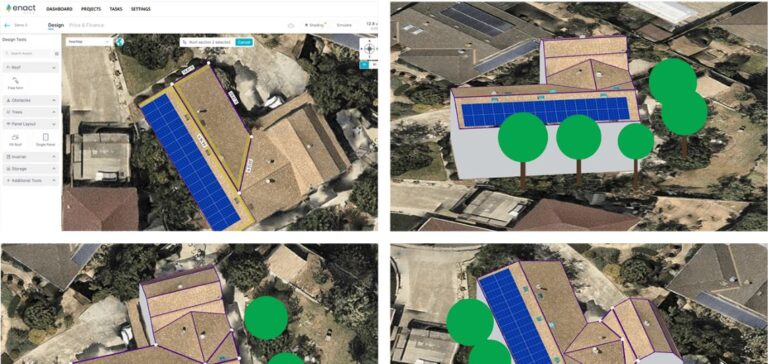

Specialized tools such as PVsyst, Helioscopes and Aurora Solar enable engineers to simulate various configurations and assess the economic viability of projects.

These programs facilitate planning, design and financial analysis, providing an overview of anticipated energy and financial returns.

Applications and Benefits of Software Solutions

Applications for solar systems cover a wide range of uses, from automation and computer-aided design (CAD) to operations management and maintenance.

These platforms enable real-time monitoring of energy production, performance parameters and maintenance schedules, ensuring optimal, sustainable operation of solar infrastructures.

Beyond the technical aspects, these programs support sales and marketing efforts by providing tools to demonstrate the viability of projects and promote solar solutions to potential customers.

The evolution of the solar software market is also marked by advances in automation and operations management, responding to the varied needs of players in the solar energy value chain.

Regional Challenges and Opportunities

The market for software technologies for photovoltaic energy faces several challenges, including a lack of skilled labor for PV system development and maintenance, land acquisition conflicts with agriculture, and regulatory uncertainties.

Despite these obstacles, regions such as North America, and particularly the United States, continue to foster software innovation thanks to a robust development ecosystem and favorable government policies.

High electricity demand and solar irradiation levels encourage the deployment of solar energy solutions in North America.

The greater presence of a skilled workforce, modern infrastructure and the headquarters of major market players such as PVsyst and Aurora Solar reinforce the region’s leadership in the development of solar system programs.

Recent Developments and Innovations

In May 2024, Valentin Software presented its revolutionary design software for photovoltaic, solar thermal and heat pump systems at Intersolar Europe in Munich.

This premium PV*SOL professional program offers new battery options, high-quality charging profiles and the latest climate data.

In March 2024, Energy Toolbase enhanced its ETB Developer package with a new feature for modeling the economics of solar and storage installations.

This innovation maximizes value streams such as grid services and electricity bill reductions, improving project economics and reliability.

Aurora Solar, in May 2023, announced its expansion into Germany to support solar organizations in streamlining operations and accelerating growth.

This expansion responds to the growing demand from German solar installers for digital and automated solutions.

The solar applications market continues to grow, offering essential tools for every stage of solar system implementation and management.

By overcoming challenges and adapting to innovations, this market promises sustained growth and significant technological advances for years to come.