The global market for liquid hydrogen micro-storage systems is expected to reach $738.6mn by 2034, up from $316.7mn in 2024, according to the latest forecasts. This growth, projected at an annual rate of 9%, is supported by expanding use across space, industrial, and energy sectors, along with increasing public and private investment in high-performance hydrogen infrastructure.

Aerospace is the main driver of demand

In 2024, systems used in aerospace and space launch applications represented the largest share of the market. The historic reliance on liquid hydrogen as rocket fuel continues to sustain demand, particularly amid the rise in commercial launches, expansion of government space programmes, and growth of private aerospace players. The defence segment, closely tied to similar cryogenic applications, also maintains a strong position.

At the same time, stationary and portable hydrogen liquid applications are expanding in industrial supply chains. They provide suitable solutions for decentralised needs, including remote supply, high-capacity backup systems, or mobile refuelling chains in demanding environments.

Vacuum-insulated tanks dominate the technology segment

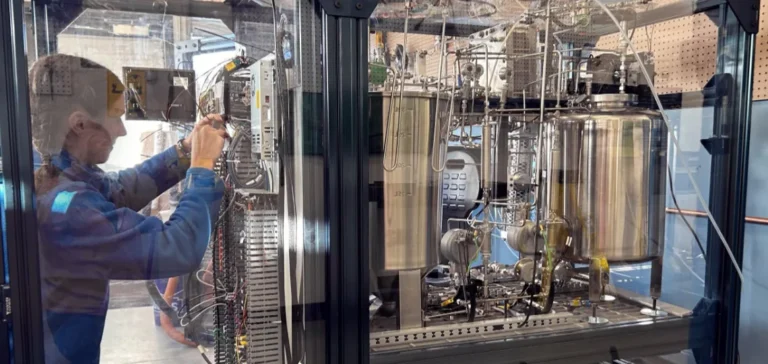

In terms of technology, vacuum-insulated cryogenic tanks accounted for the majority of the market in 2024. Their ability to maintain hydrogen at extremely low temperatures while reducing evaporation loss makes them a reference solution for secure storage. These tanks remain central to modern installations and benefit from ongoing research into advanced insulation materials.

Other systems, such as vacuum-insulated pipelines or next-generation cryogenic vaporisers, are seeing increased adoption. These solutions allow more precise liquid hydrogen transfer and meet the need for flexible, on-demand operations in environments with variable constraints.

North American leadership and rapid growth in Asia-Pacific

North America held the largest market share in 2024 and is expected to maintain this position through 2034. This trend is supported by investments in space, defence, and hydrogen infrastructure in the United States. The presence of key suppliers and advanced cryogenic technologies, along with public initiatives like regional hydrogen hubs, supports this leadership.

Asia-Pacific, however, is showing the fastest market growth, with large-scale green hydrogen projects underway in South Korea, Japan, China, and Australia. These countries are actively building their production, storage, and distribution ecosystems, relying on industrial partnerships to deploy micro-storage solutions suited to decentralised logistics.