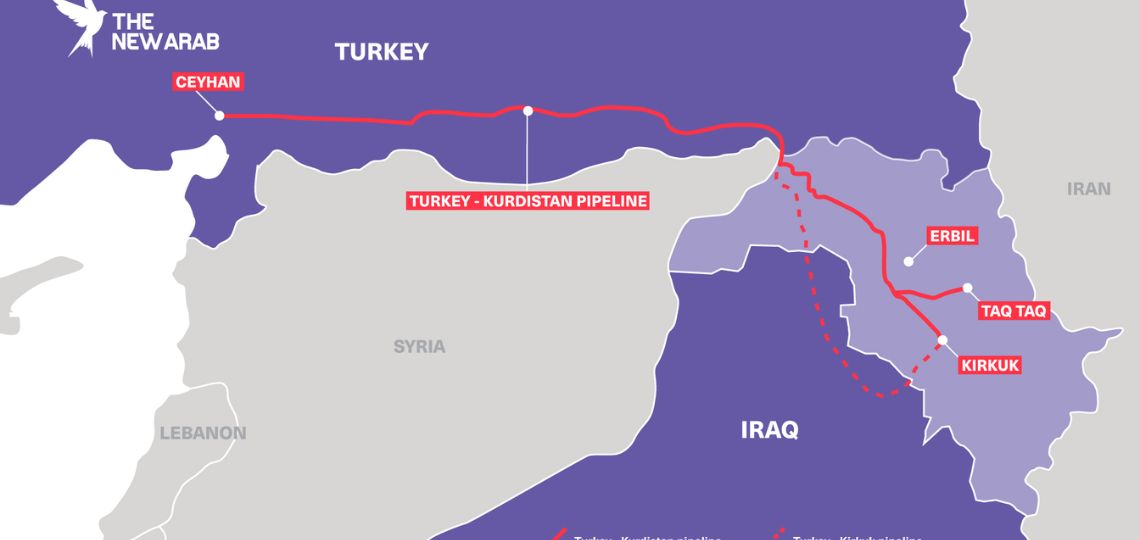

Located in northern Iraq, Iraqi Kurdistan, a politically autonomous region, plays a key role on the energy scene due to its substantial oil reserves. Officially recognized by the 2005 Iraqi constitution, the region is bordered by Iran to the east, Turkey to the north and Syria to the west, forming an integral part of the Kurdistan region. Erbil is the capital.

The Oil Road: How Kurdistan shaped its economic future

Since 1991, Kurdistan’s economy has been based on the independent export of its oil, particularly after the Gulf War and the establishment of Kurdish autonomy in the governorates of Dohuk, Erbil and Sulaymaniyah. This autonomy was reinforced with the creation of a federal Iraq in 2003, consolidating the region’s predominant economic role.

The Duality of the Iraqi Oil Market: Kurdish Oil Prices in Question

Kurdistan’s economy is largely dominated by the oil industry. However, since the late 2010s, Kurdish officials have sought to diversify the economy in order to mitigate the risks of another economic crisis, similar to the one that affected the region during the fight against the Islamic State (EI).

Our main oil export partners include Israel, Italy, France, Greece and, of course, Turkey, our most important partner. By 2021, Kurdish production had already reached 445,000 barrels per day. Kurdish authorities fear that it will halve by 2027, dropping to 290,000 barrels per day compared with 580,000 if the expected investments are carried out.

Recently, Iraq has sought to exert control over oil exports from Kurdistan, with the aim of limiting that region’s autonomy and reducing competition with its own oil exports. Kurdish oil prices were frequently $10 to $20 per barrel lower, creating a duality on the Iraqi oil market.

In addition, the Kurdish region is a major crossroads for the smuggling of over 40,000 barrels of oil a day from Iraq to neighboring countries.

The Oil Industry in Iraqi Kurdistan: Between Growth and Conflict with Baghdad

Taking advantage of price variations between heavily subsidized fuels in Iraq, with the exception of Kurdistan, and higher rates in neighboring countries such as Syria, some Iranian-backed Shiite militias have found a lucrative opportunity through oil arbitrage. This has raised concerns about the economic and political consequences for Iraq and the region.

However, this oil wealth has become a major point of contention between the Kurdish regional government and the central government in Baghdad. Over the decades, Iraqi Kurdistan has developed a steadily growing oil industry, attracting significant foreign investment, notably from Turkey, which has contributed to increased oil production.

The rapid expansion of the oil and gas industry in Iraq’s autonomous Kurdistan region has had significant regional consequences since the conclusion of an agreement between Ankara and Erbil in November 2013.

The impact of the agreement between the Kurdistan Regional Government of Iraq and Ankara

This agreement, now defunct, had a considerable impact on the region. According to Gareth Stansfield in an article for Science Po, this pact, made public on November 6, 2013, included a comprehensive set of agreements and arrangements between the Kurdistan Regional Government and Turkey.

It paved the way for the development of oil and gas pipelines to export the Kurdistan Regional Government’s hydrocarbons to Turkey and world markets.

Under this plan, the Kurdistan Regional Government had the option of exporting 2 million barrels a day of oil and over 10 billion cubic meters of gas to Turkey.

Oil diplomacy: Kurdistan and Baghdad face a Sovereignty Conflict

Since the signing of this agreement, Iraqi Kurdistan has become a major supplier of oil and gas to Turkey, boosting their economic relations.

However, this has also caused friction with the central Iraqi government, which has questioned the legality of these Kurdish oil exports to Turkey.

As explained by Gareth Stansfield:

“Once the agreement became official, Baghdad became increasingly opposed to the relationship, threatening legal action to prevent the export of what it considered “Iraqi oil”. Meetings were held between KRG and Iraqi government delegations throughout January 2014, with Iraqi Deputy Prime Minister Shahristani maintaining his usual opposition to Kurdistan’s actions, warning of the “fiscal” actions Iraq could take if oil were sold outside the SOMO (State Oil Marketing Organization) regulatory framework. Nechirvan Barzani’s position was equally resolute: Kurdistan will not accept a situation where the operation and success of its oil and gas sector is controlled by Iraqi government institutions”.

The 2017 Iraqi Kurdistan Referendum: Unexpected Repercussions and Lessons Learned

On September 25, 2017, Iraqi Kurdistan held a second referendum on its independence, seeking the population’s opinion on the separation of this region of Iraq.

This initiative exacerbated tensions with Baghdad and other regional governments, resulting in the loss of control over economically crucial territories, including the oil-rich region of Kirkuk.

Indeed, according to the analyses of Katie Klain and Lisel Hintz, the KRG has drastically miscalculated politically by underestimating many factors, including the reaction of regional actors:

“For example, Iran and Turkey were concerned that the referendum could encourage independence movements among their own Kurdish minorities and thus destabilize the region as a whole. With around 8 million Kurds in Iran – almost as many as in Iraq – and around 15 million in Turkey, the two states coordinated their efforts with Iraqi forces to conduct joint exercises and adopt an offensive stance, to make clear their opposition to the referendum.”

1.4 Billion Penalty: Turkey Convicted in Kurdish Oil Export Case

Despite the tensions, energy cooperation between Turkey and Iraqi Kurdistan has been maintained, with the construction of new pipelines and an increase in hydrocarbon exports to Turkey until March 2023.

However, on March 27, 2023, the arbitration tribunal of the International Chamber of Commerce in Paris ruled that Baghdad was the only entity authorized to manage exports via the Turkish port of Ceyhan.

He also ordered Turkey to pay $1.4 billion in penalties in a 2014 case relating to oil exports from Iraq’s Kurdistan region.

Kurdistan and Turkey at an impasse: when will oil exports return?

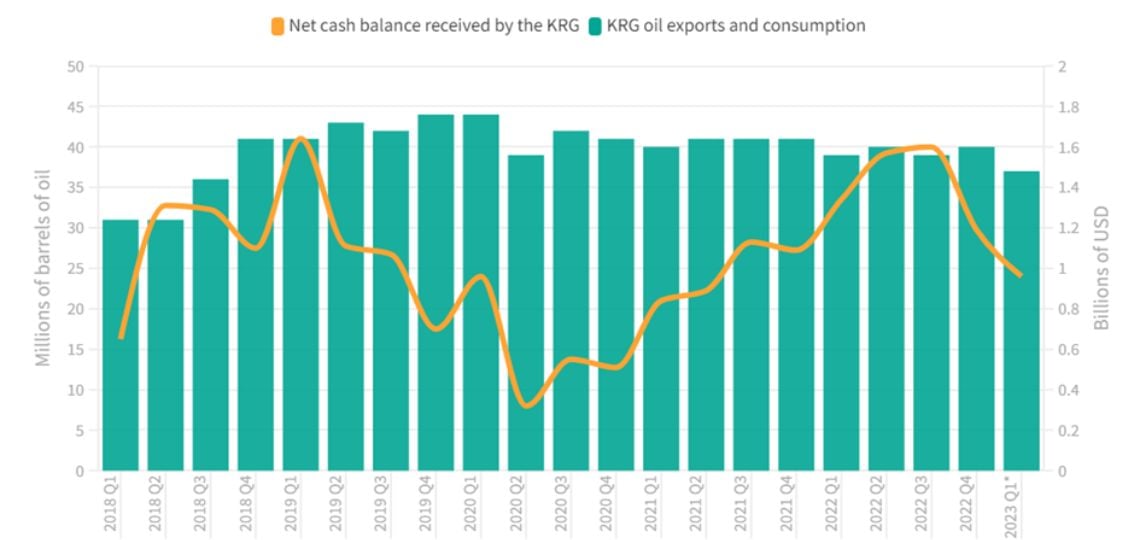

This decision led to a halt in Turkey’s imports from the autonomous region of Iraqi Kurdistan. Total oil exports from Iraqi Kurdistan via Turkey amounted to around 450,000 barrels a day.

According to Reuters, oil companies in the region are in a state of uncertainty, as the pipeline shutdown is expected to continue until Ankara, Baghdad and the Kurdistan Regional Government (KRG) reach an agreement to resume exports.

Oil, the key to autonomy for Iraqi Kurdistan

The oil history of Iraqi Kurdistan is essential to understand because of the recent discovery of vast reserves of conventional oil, which has influenced its quest for autonomy.

These reserves have attracted significant foreign investment, notably from Turkey, contributing to the growth of the regional oil industry.

For example, the Kirkuk-Ceyhan pipeline is a 36-inch (910 mm) diameter conduit with a capacity of 150,000 barrels per day (24,000 m³/day), and until very recently it was used to export oil from the Taq Taq and Tawke oilfields in particular.

The Tawke Oil Field: A Pillar of Production in Iraqi Kurdistan

The Tawke oil field is one of the most important in Iraqi Kurdistan. It was discovered in 2005 by Norwegian oil company DNO International and General Energy. In the first quarter of 2023, gross production from the Tawke field averaged 93,880 barrels per day.

The Peshkabir field contributed 49,480 barrels per day, down on the previous quarter, while the Tawke field produced 44,400 barrels per day, also down due to well renovation work in February. There was no production in Q2 due to the pipeline shutdown.

Shaikan Field: The Success Story of Oil Production in the Region

Discovered in 2009 by Gulf Keystone Petroleum, owned by Gulf Keystone Petroleum and MOL Hungarian Oil and Gas, the Shaikan field is one of the largest in Iraqi Kurdistan.

The Shaikan field has been in production since July 2013 and has produced over 117 million barrels of reservoir oil equivalent (“MMstb”) to March 2023, with average gross production increasing by 40% between 2018 and 2022.

Atrush Field: A Major Oil Project in the Heart of Kurdistan

Located in the province of Dohuk, the Atrush oil field was discovered by Canadian oil company Shamaran Petroleum in 2011. It is owned by the latter (27.6%), Abu Dhabi National Energy (47.4%) and GRK (25%).

The field covers 269 km², came on stream in July 2017, and was producing at a rate of 34,000 barrels of oil per day in 2020, aiming to reach 80,000 bopd by the end of 2020.

Luhais Field: A Pillar of Long-Term Oil Production in Iraq

The field was discovered in 2008 by Austrian oil company OMV. It is owned by Dhi Qar Oil. Oil companies have already extracted 66.87% of the field’s total recoverable reserves, reaching peak production in 2018.

Production is expected to continue until the field reaches its economic limit in 2053, currently contributing around 2% of the country’s daily output.

The Kurdistan Petroleum Agreements: Between Economic Independence and Legal Controversy

The economic expansion of Iraqi Kurdistan has strengthened its economic independence, provoking tensions with the central government in Baghdad.

Disagreements persist over the management of oil resources, with Baghdad claiming that Kurdistan’s agreements with foreign companies are illegal.

Oil revenues are crucial for financing the Kurdish regional government. Turkey, as a neighboring country, plays a significant role in this dynamic, and several partnerships are at stake.

Karim SAHIB / AFP

Towards a resolution?

Oil negotiations between Baghdad, Erbil and Ankara are underway to resolve revenue-sharing issues and establish a legal framework for oil exploitation.

However, fully resolving these disputes remains a complex challenge, requiring the political will of all parties concerned.

Historic Press Conference: The Meeting between Hakan Fidan and Masrour Barzani in Erbil

Last March, following a ruling by the international tribunal, Turkey halted the transit of Kurdish oil through its territory. In May, Iraq expressed the hope of a “final agreement” with Turkey for the resumption of oil exports.

Nevertheless, financial and, above all, security issues remain unresolved. The new head of Turkish diplomacy, Hakan Fidan, held a joint press conference with Masrour Barzani, Prime Minister of the Kurdish Regional Government of Iraq, in Erbil at the end of August 2023, following their meeting. They discussed bilateral relations in detail.

Diplomatic Dynamics: Talks between Turkey, Baghdad and Erbil

He pointed out that relations between Ankara and Baghdad are progressing very dynamically, adding that Türkiye’s relations with Baghdad and Erbil have always, and at all levels, retained their importance on the country’s agenda.

But beyond the question of hydrocarbon resources and Turkey’s resumption of oil production, there was also talk of Ankara’s concerns about the presence of the PKK in certain areas of Iraq.

“We had the opportunity to discuss economic issues, the development road project, the fight against terrorism, the water issue and the reconstruction of Iraq, infrastructure and superstructure projects with the relevant authorities,” he said.

IRAQI PRIME MINISTER’S PRESS OFFICE / AFP

Before adding,

“We still have a long way to go to get rid of terrorism. We have solved this problem to a large extent in Türkiye. For the moment, PKK terrorism is hiding on Iraqi territory. Both the Baghdad and Erbil administrations are very determined to eliminate PKK terrorism from Iraqi territory. We welcome this. We will give these authorities every possible support.

The New Oil Reality: Baghdad’s Ascendancy over Iraqi Kurdistan

The question of oil and security remains a sensitive issue that will continue to influence relations between Turkey and Iraq, as well as regional stability in the Middle East.

Energy issues remain at the heart of the region’s geopolitical dynamics.

In this new status quo, Baghdad has much more leverage than the KRG in the negotiations, according to Joshua Krasna :

“The arbitration decision and the Turkish suspension of the oil shipment have served Baghdad’s efforts to damage the KRG’s (Kurdistan Regional Government) international position and limit its independent foreign and economic policies well. The new political and economic reality is forcing Erbil to accept arrangements under the new budget law that it would probably have rejected before. The loss of control over its main source of revenue will result in a significant loss of autonomy, although it may also alleviate some of the economic problems, including corruption and non-payment of salaries and pensions, that have plagued the Kurdish region for a decade. The new situation will help Baghdad manage energy development and policy on a national scale, and should also make it easier for Baghdad to ensure that Kurdish energy and export policy does not conflict or compete with federal policy.”

These multi-faceted tensions between Turkey, Iraq and the Kurdish question have a significant impact on regional dynamics.

This delicate situation contributes to ongoing tensions between the two countries, and highlights the importance of energy and geopolitical issues in the region.