Greenhouse gas emissions produced by major telecom operators and data centres in France increased by 7% in 2023, according to a report published by the Autorité de régulation des communications électroniques, des postes et de la distribution de la presse (Arcep) on April 17. This rise occurred despite a nationwide decrease in emissions of 5.8% over the same period.

Orange, SFR, Bouygues Telecom and Free collectively emitted 397,000 tonnes of CO2 equivalent, representing a 4% increase compared to 2022. According to the figures provided, this amount is equivalent to 225 round-trip flights between Paris and New York. The increase reflects both direct and indirect emissions, driven largely by greater energy consumption from mobile networks.

Rising pressure on mobile networks

Electricity consumption by telecom infrastructure reached 4.1 terawatt hours (TWh) in 2023, a 2% year-on-year increase. This trend stems from a 6% rise in energy use across mobile networks, while fixed-line networks saw a 14% reduction. The growth in data traffic, fuelled by widespread digital usage and the rollout of 5G, has been a key factor.

Arcep noted that the expanding demand for mobile connectivity, combined with heavier usage from video streaming and real-time communication, continues to place significant strain on existing infrastructure. The expansion of network capacity and antenna densification further amplify the sector’s energy burden.

Data centres report double-digit growth

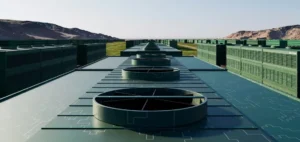

Data centres, which provide the computing power essential for large-scale information processing, recorded an 11% increase in greenhouse gas emissions in 2023. This change reflects a substantial rise in electricity consumption required to support these facilities’ operations.

In parallel, the volume of water withdrawn by data centres reached 681,000 cubic metres in 2023, mostly sourced from potable water. This represents a 19% year-on-year increase and marks the second consecutive year of significant growth. The rise is mainly attributed to heightened cooling requirements for IT equipment.

According to the Agence de la transition écologique (Ademe), the digital sector accounted for 4.4% of France’s national carbon footprint in 2022. This figure may evolve if current energy consumption trends persist in the coming years.