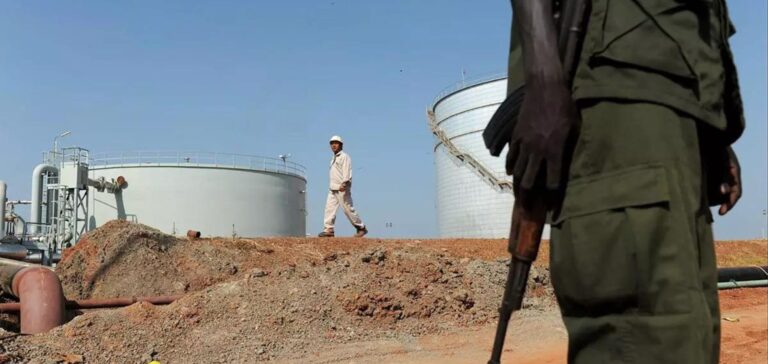

Concerns are growing about oil production and exports in Sudan and its more productive southern neighbor as fighting over a fierce power struggle between military leaders has continued for three days. Sudan, the smallest producer in the OPEC+ coalition, produces about 60,000 barrels per day, about 100,000 barrels per day less than its southern neighbor, the third largest producer in sub-Saharan Africa.

However, South Sudan depends on Sudan to export its oil, which travels through a pipeline to the Red Sea via Khartoum, where explosions and gunfire were heard on April 17.

No immediate effects on oil supply yet, but observers remain vigilant

Although there were no immediate reports of the impact on oil production, refining or export operations in Sudan since the fighting began on April 15 in the capital, near the border with South Sudan, and in Port Sudan, oil market observers remained vigilant. “Exports through the pipeline could be affected,” Alex Vines, head of the Africa program at Chatham House, told S&P Global Commodity Insights. “I think that’s one of the reasons why Juba offered to mediate.” Adhieu Majok, a South Sudanese analyst, said: “The feeling around South Sudan is that if the conflict continues to escalate, it will affect oil production and revenues.

The grades of crude oil exported from Sudan and South Sudan are Nile and Dar Blend, which are sold mainly to Asian refiners in China, India and Malaysia. Platts, a division of S&P Global Commodity Insights, valued Dar Blend FOB Marsha Bashayer oil terminal on the Red Sea at $84.38/barrel on April 14, a discount of $3.5/barrel to dated Brent.

Conflict in Sudan could spill over to its southern neighbor

The power struggle centers on a conflict between General Abdel Fattah al-Burhan, head of the armed forces and effective president, and his deputy, General Mohamed Hamdan Dagalo, who heads the formidable Rapid Support Forces. The generals, who took power in October 2021 after the overthrow of former President Omar al-Bashir, were preparing to hand over the country to civilian rule.

Sudan and South Sudan signed a transitional financial agreement in 2011, after South Sudan gained independence, in which Juba pays fees and non-commercial tariffs to Khartoum to export its oil to international markets. South Sudan, which depends on oil revenues for 95% of its national budget, has in the past accused Sudan of diverting its oil to its domestic refineries without consent.