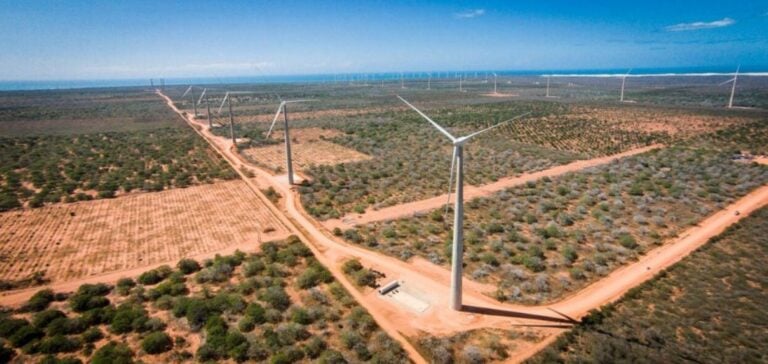

State Power Investment Corporation (SPIC), a Chinese electricity company, has unveiled a massive investment of 780 million reais ($147.41 million) to build two new wind farms in northeast Brazil. This initiative also marks SPIC’s entry into the Brazilian solar sector, with the inauguration of two large-scale solar farms. SPIC, seeking to diversify its energy portfolio and become one of the top three energy producers in Brazil, has revealed its ambitious plans through Adriana Waltrick, CEO of SPIC’s Brazilian subsidiary. The new wind farms, located in the state of Rio Grande do Norte, will have a combined installed capacity of 105.4 megawatts (MW) and will target the open energy market. Construction is due to start in January 2025, with commissioning scheduled for the following year.

Expansion in the Solar Sector

This week, SPIC also inaugurated solar farms in the states of Piauí and Ceará, with a total capacity of 738 megawatt-peak (MWp). These parks, in which SPIC holds a 70% stake, were initially developed by Recurrent Energy, a subsidiary of Canadian Solar. Recurrent Energy remains a shareholder and operator of the projects. The investment in these solar installations amounts to 2 billion reais, and all the energy produced will be sold on the open market. Around 65% of this energy has already been sold under long-term contracts, while the remainder will be negotiated under shorter-term contracts. They are in addition to Brazil’s various solar projects.

Renewable ambitions of SPIC

These projects illustrate SPIC’s appetite for the Brazilian market and renewable energy sources, as stated by Adriana Waltrick. SPIC currently has an installed capacity of around 3,800 MW, with assets in operation in Brazil, a priority market for the Chinese company. In addition to these projects, SPIC is awaiting news from the Brazilian government regarding the energy auctions scheduled for this year. The company is also interested in possible bids for new hydroelectric power plants, should the government decide to relaunch such projects. SPIC is also exploring the production of green hydrogen, combined with the installation of offshore wind turbines, a generation technology already mastered by the company outside Brazil. SPIC’s commitment to these projects reflects not only its energy diversification strategy, but also its leadership role in the transition to more sustainable energy sources.