South Korea has just approved the construction of the Shin Hanul 3 and 4 nuclear reactors at Uljin, marking a turning point in its energy strategy.

The decision, taken by the Nuclear Safety and Security Commission, marks a clear break with the previous policy of reducing the share of nuclear power in the country’s energy mix.

Since Yoon Suk Yeol came to power in 2022, the goal has been clear: to increase the share of nuclear power from the current 30% to 36% by 2038.

The two new reactors will each have a capacity of 1.4 gigawatts and will be built by Korea Hydro & Nuclear Power Company, a key player in South Korea’s energy sector.

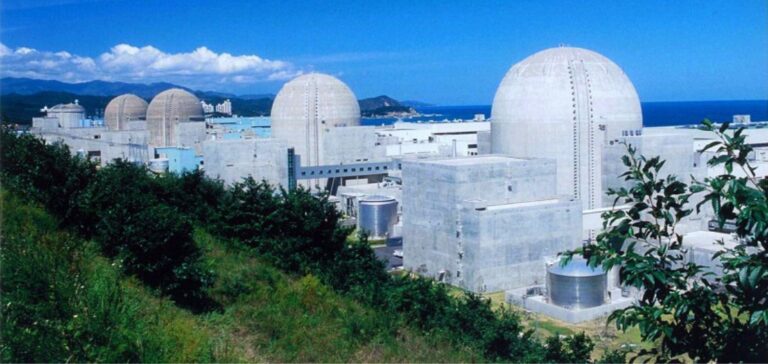

The site chosen for construction, Uljin, is already home to several reactors, making it one of the country’s main nuclear hubs.

The authorities assure us that no significant geological risks have been identified, a crucial condition for guaranteeing the safety of the facilities.

Change of course in South Korea’s energy policy

Under President Moon Jae-in, South Korea began a gradual phase-out of nuclear power, motivated by security concerns and a growing commitment to renewable energies. However, the transition was not without consequences for the industrial and energy sectors.

The new orientations of the Yoon Suk Yeol administration aim to address the country’s challenges of energy stability and competitiveness, by maintaining a balance between security of supply and energy costs.

The nuclear industry is seen as an asset not only to support domestic energy needs, but also to strengthen South Korea’s position internationally.

Reactor modernization, as well as support for new-generation technologies such as small modular reactors (SMRs), are envisaged to diversify and solidify the country’s energy strategy.

International prospects and challenges

Approval of the Shin Hanul 3 and 4 reactors is also part of a broader strategy to strengthen South Korea’s position in the global nuclear market.

Nuclear technology exports are seen as a strategic lever for the South Korean economy.

The country aims to win reactor construction contracts abroad, particularly in Eastern Europe and Southeast Asia, where demand for nuclear power remains strong.

The government, while promoting these developments, insists on the importance of strict safety standards and increased transparency to avoid incidents that could compromise its position on the global market.

Korea Hydro & Nuclear Power Company’s technological arsenal and expertise are strong arguments in the competition with other players such as EDF in France or Rosatom in Russia.

Criticism and internal opposition

However, this policy shift is not without controversy.

Internal pressure groups, such as Energy Justice Actions, are voicing serious concerns about the safety of the population and the concentration of nuclear reactors in specific areas such as Uljin.

With these two new units, the city will have ten reactors, a density rarely seen on a global scale.

According to these groups, such a concentration could increase the risk in the event of an incident, despite the safety guarantees put forward by the authorities.

For industry players, the response to these criticisms is strategic.

Discussions about nuclear waste management, the safety of facilities, and the potential impact on local communities are key issues that require rigorous and transparent communication on the part of the authorities and companies concerned.

Impact on the South Korean energy market

Expansion of the nuclear fleet could also influence the domestic energy market.

Increased nuclear generation capacity could reduce dependence on fossil fuel imports and improve the balance of trade.

However, the equation is not straightforward; the variability of renewable energy prices, the costs of building nuclear infrastructure, and the delays inherent in these projects also influence economic projections.

Energy companies and investors are keeping a close eye on the government’s decisions.

Clarification on future regulations and subsidies in the nuclear sector is expected to adjust investment strategies.

Financial players, both local and international, are also assessing the potential impact on South Korea’s credit and reputation in a context where the energy transition is being closely watched.

The revival of nuclear power in South Korea reflects the country’s determination to guarantee energy security while remaining internationally competitive.

While the challenges of safety and profitability remain, the decision to build new reactors at Uljin demonstrates a clear ambition on the part of the South Korean government to position the country as a leader in a fast-changing energy sector.