Global installed capacity of small modular reactors (SMRs) is projected to rise from 312.5 MW in 2025 to 912.5 MW by 2030, according to forecasts from Mordor Intelligence. This growth, averaging a compound annual rate of 23.9%, is being propelled by demand for clean industrial heat in remote areas and intensifying global decarbonisation targets.

Industries target off-grid process heat

Companies in the chemical, manufacturing and mining sectors are exploring SMRs for their ability to supply both high-temperature heat and electricity in a compact format. Remote mining operations, in particular, view SMRs as viable replacements for diesel-based systems. These premium heat applications yield higher margins and help offset the capital expenditure associated with nuclear deployment.

Climate mandates fuel SMR deployment

As firms commit to net-zero targets, many are turning to nuclear sources for reliable, zero-carbon baseload capacity. This shift is encouraging more direct partnerships between industrial actors and advanced reactor developers, moving beyond traditional utility-led procurement. National energy security strategies are also reinforcing interest in SMRs as a stable complement to renewable generation.

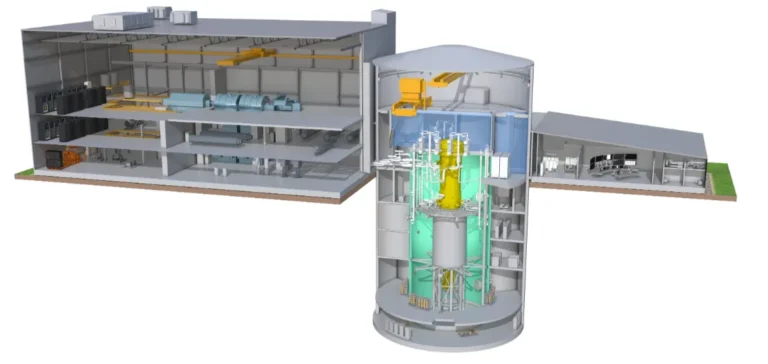

Factory-built reactors reduce financial risk

Unlike conventional nuclear projects, SMRs are designed for off-site construction, enabling shorter build times and improved cost control. Parallel construction activities, repeatable supply chains and component standardisation contribute to more predictable project delivery. Vendors are balancing globally sourced manufacturing with domestic content requirements to meet both regulatory and commercial expectations.

Europe leads, North America remains cautious

Europe is emerging as the fastest-moving region, supported by coordinated policymaking and joint initiatives that streamline regulatory approvals and standardise reactor choices. In North America, regulatory progress and early construction permits reflect growing confidence in the technology, although labour costs and layered regulatory frameworks continue to slow broader rollout. In Latin America and the Middle East, SMR development remains at an early stage, largely dependent on external financing and technical partnerships.