China Petroleum & Chemical Corporation (Sinopec) has begun operating 65,000 WiNG nodal sensors, supplied by the French group Viridien under its Sercel brand, to conduct a three-dimensional seismic survey in the Tabasco and Veracruz states of southeastern Mexico. This operation is part of an exploration project covering approximately 3,000 square kilometres, with topographical conditions considered particularly challenging.

A system designed for difficult environments

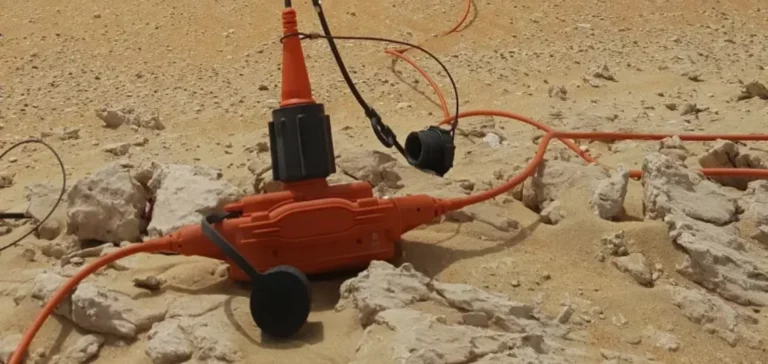

The WiNG nodal technology developed by Sercel is based on a modular architecture tailored for extreme environments, including wetlands, swamps and densely forested areas. The system uses optimised wireless communication technology to transmit high-resolution data in real time. According to information provided by Viridien, this capability enables field teams to remotely monitor the entire acquisition network and apply consistent quality control to the collected data.

Field operations are currently in the production phase and proceeding according to the initial schedule. The performance of the WiNG technology is considered critical to the success of this imaging campaign, particularly in geologically complex settings where data accuracy is essential for subsequent exploration operations.

A strategic project for Viridien in Latin America

Viridien, parent company of Sercel, is thereby strengthening its commercial presence in Latin America, a strategic market for seismic acquisition technologies. This contract marks a milestone in the relationship between Viridien and Sinopec, who had already collaborated on other projects in the region.

Jerome Denigot, Head of Sensing & Monitoring at Viridien, stated: “This delivery marks an important milestone in our long-standing partnership with Sinopec. The progress of the project confirms the robustness of our technology and the quality of support provided by our on-site teams.”

The WiNG system, which integrates Pathfinder transmission management technology, will also be used to deploy the latest generation of Accel-type sensors, according to the company. These sensors are designed for high-density seismic surveys and are compatible with the most demanding terrestrial environments.