The government of Singapore, through the Energy Market Authority (EMA), recently announced the co-funding of feasibility studies for carbon capture and storage (CCS) projects proposed by energy companies. This effort is part of the national strategy to achieve carbon neutrality by 2050. Singapore, which relies heavily on natural gas for electricity production, aims to reduce its emissions while maintaining energy security by integrating innovative technologies such as CCS.

Carbon capture and storage (CCS) is a vital process for countries heavily dependent on fossil fuels. It involves capturing carbon dioxide (CO2) emitted by power plants and storing it in underground geological reservoirs or reusing it in industrial processes. Singapore sees this technology as a key solution to mitigate emissions while continuing to use natural gas, a dominant energy source in its energy mix.

Carbon Capture Pathways Studied

The EMA announced that it will focus on two main carbon capture technologies. Post-combustion capture, which involves capturing CO2 from the exhaust gases of combined-cycle gas turbines (CCGTs) after combustion, allows existing infrastructure to be upgraded. This solution is particularly suited for already established power plants, such as those providing the majority of Singapore’s electricity. Pre-combustion capture, on the other hand, extracts CO2 during the conversion of natural gas into hydrogen, a cleaner fuel. This technology holds significant potential for Singapore, which aims to include hydrogen in its future energy mix.

The funded studies will assess the feasibility of these two approaches, considering local specifics, existing infrastructure, and associated costs.

A Strategic Commitment to Carbon Neutrality

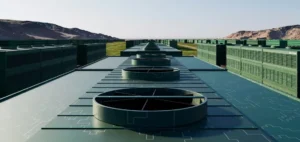

Beyond feasibility studies for power plants, Singapore has also initiated the development of a large-scale carbon storage infrastructure on Jurong Island, its main industrial hub. This project aims to aggregate CO2 emissions from various industrial sectors and store them abroad, as Singapore has limited geological storage capacity. The first phase of this project is expected to be operational by 2030, and is part of an integrated approach to managing carbon emissions on a national scale.

Hydrogen as a Pillar of the Energy Transition

Exploring carbon capture during pre-combustion for hydrogen production is a central element of Singapore’s energy strategy. Hydrogen is seen as a future solution for decarbonizing sectors that are difficult to electrify, such as heavy industries and maritime transport. By capturing CO2 during the production of hydrogen from natural gas, Singapore could reduce the carbon impact of this new energy source, ensuring a cleaner energy transition.

Challenges of Carbon Capture and Storage

Although promising, CCS faces significant technical and financial challenges. The high cost of implementing and operating these technologies is a major obstacle, as is the need for sophisticated infrastructure to transport and store captured CO2. Additionally, as a small island nation, Singapore will likely need to enter into international agreements to store its CO2 in geological formations abroad, adding logistical and diplomatic complexity to the equation.

The feasibility studies co-funded by the EMA will need to address these key questions, determining whether CCS can be implemented on a scale that justifies its cost and impact on climate goals.

Economic and Environmental Implications

By investing in CCS, Singapore not only reduces its emissions but also positions itself as a regional leader in carbon management technologies. Global demand for carbon management solutions is expected to rise, and Singapore could become a hub for innovation in this sector, offering new economic opportunities and green jobs.

By funding these CCS studies, Singapore demonstrates a strong commitment to its climate goals while recognizing that the transition to a low-carbon economy requires a multifaceted approach. CCS will play a crucial role in this transition, enabling Singapore to maintain its energy security while reducing its carbon footprint. With projects such as CCS on Jurong Island, the country shows that it is possible to balance economic growth with environmental responsibility.