Shell Canada and its affiliates announced on January 29, 2025, an agreement with Canadian Natural Resources Limited regarding the exchange of their stake in the Athabasca Oil Sands Project (AOSP). Under this agreement, Shell will exchange its remaining 10% interest in the Albian mines for an additional 10% interest in the Scotford upgrader and the Quest carbon capture and storage (CCS) facility. Once the deal is completed, Shell will hold a 20% interest in these facilities and fully exit AOSP’s mining operations.

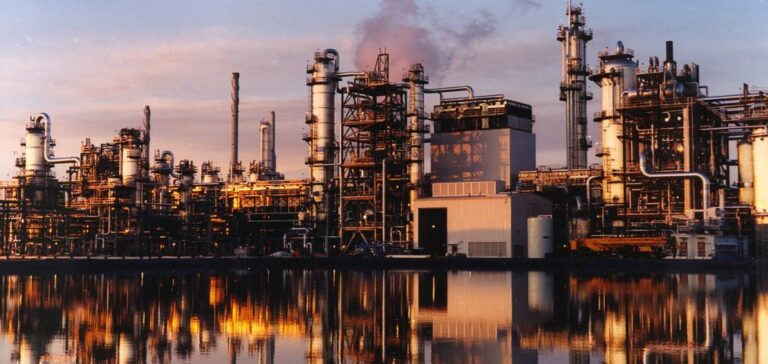

The Scotford facilities, which include the upgrader and the Quest CCS site, are located next to Shell’s 100% owned Scotford refinery and chemicals plants near Edmonton, Alberta. After the transaction, Shell will remain the operator of these facilities, a key part of its strategy to maximize the value of its upgrading, CCS, and refining projects.

Machteld de Haan, Executive Vice President of Chemicals and Products at Shell, commented: “This announcement allows us to focus more on the Scotford site and maximize the value of our upgrading, CCS, and refining projects.”

The transaction is subject to regulatory approvals and is expected to close in Q1 2025.

Context of the Transaction

Shell initially developed the Athabasca Oil Sands Project as a 60% equity owner. In 2017, Shell’s stake was reduced, and currently, Canadian Natural holds 80% of AOSP, while 1745844 Alberta Limited (1745AB) holds 20%, a joint venture between Shell and Canadian Natural. As part of this swap, Shell’s remaining mining interest and associated synthetic crude oil reserves will be exchanged for an additional 10% interest in the Scotford upgrader and the Quest CCS facility, bringing Shell’s total stake to 20%.

This move will result in the de-booking of associated proved reserves, which, at the end of 2024, stood at 741 million barrels, 50% of which were attributable to the non-controlling interest.

Impact on Shell’s Operations in Canada

With this transaction, Shell is gradually exiting mining activities in Alberta and focusing on strategic areas like refining and carbon capture projects. In addition to its interest in the Scotford facilities, Shell retains a 40% stake in the LNG Canada project, upstream operations in British Columbia and northwest Alberta, as well as the Sarnia Manufacturing Centre in Ontario. The company also continues to operate around 1,400 Shell-branded sites across the country.