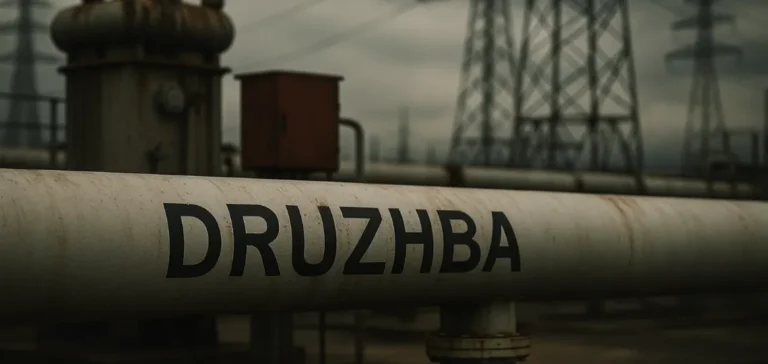

Crude oil deliveries from Russia to Hungary and Slovakia were suspended on Monday, according to Hungarian and Slovak authorities. The disruption follows what Budapest described as a second attack in two weeks on the Druzhba hydrocarbon transport network, which remains one of the few Russian oil arteries exempt from the European embargo.

Hungarian Foreign Minister Peter Szijjarto stated that the pipeline leading to the Százhalombatta refinery, in the center of the country, had been targeted again, cutting supplies. He noted that Russian technicians were attempting to restore a transformation station considered critical to the pipeline’s operation. No timeline for resumption has yet been communicated, according to statements attributed to Russian Deputy Energy Minister Pavel Sorokin.

Operational Consequences on the Regional Network

Slovak company Transpetrol, which operates the national segment of the pipeline, confirmed the suspension of flows on Monday, without providing further details on the precise causes of the interruption. The Druzhba system, designed during the Soviet era, crosses Ukraine before branching out to several destinations in Central Europe, including Hungary, Slovakia, and the Czech Republic.

Last Thursday, Budapest had already reported a Ukrainian drone strike against a Druzhba pumping station. At the time, Pavel Sorokin mentioned a possible resumption of deliveries the next day, suggesting ongoing vulnerability within the system.

Regulatory Framework and Persistent Dependencies

Despite the European Union’s embargo on most Russian oil imports following the 2022 invasion of Ukraine, a derogation was granted for land-based flows through the Druzhba pipeline, allowing Hungary and Slovakia to maintain access to this supply route. The Czech Republic, formerly a recipient of this line, ended its reliance earlier this year after connecting to another infrastructure from Italy.

Rising tensions surrounding this infrastructure highlight the logistical fragility of certain Central European countries, where energy diversification remains limited. Security and supply challenges continue to influence strategic decisions across the region.