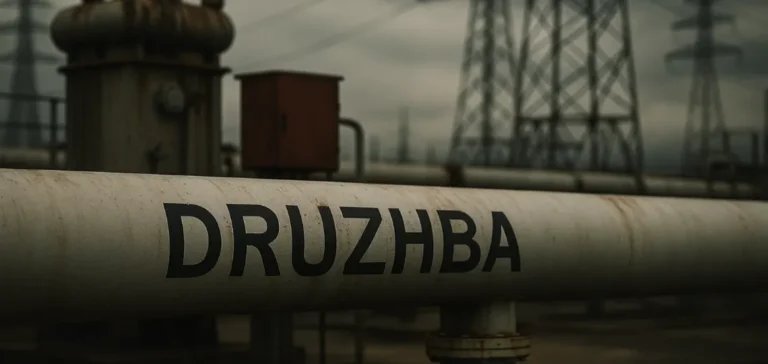

Russian crude oil flows to Hungary via the Druzhba pipeline have been restored, according to Hungarian Foreign Minister Peter Szijjarto. The resumption follows two Ukrainian drone strikes targeting a pumping station in Unecha, Russia, which temporarily halted deliveries to Hungary and Slovakia.

The attacked pumping station has the capacity to transport up to 1.5 million barrels per day, sending crude toward Central Europe and Russia’s Ust-Luga export terminal. Slovak authorities described the service disruption as concerning but said the country could rely on strategic reserves if a prolonged stoppage occurred.

Persistence of Energy Relations with Moscow

Hungary and Slovakia remain among the last European Union member states to import Russian crude by pipeline, while other countries such as the Czech Republic have reduced reliance on this route. This divergence raises questions over the unity of the EU’s approach toward Russian energy imports amid the ongoing war in Ukraine.

The Hungarian minister described the strikes as a direct threat to national energy security and warned against further disruptions, noting that Hungary also contributes to Ukraine’s electricity supply.

Commercial Agreements and Profitability Trade-offs

Hungarian energy group MOL continues to source most of its supply through Druzhba, despite signing a contract in February 2025 with Croatian operator Janaf for crude shipments via the Adria pipeline. The agreement covers 2.1 million metric tons of crude delivered to the Bratislava and Danube refineries, equivalent to about 42,000 barrels per day, or roughly 15% of their combined capacity.

However, MOL has stated its facilities will not be fully compatible with the Adria pipeline until 2026. The company has cited high logistical costs as the main barrier to fully replacing Russian crude, without specifying a timeline for ending these purchases.

Druzhba Network Extension Toward Serbia

Alongside this partial diversification, MOL plans an extension of the Druzhba pipeline in cooperation with the Serbian government. The project would connect the Pancevo refinery in Serbia to Szazhalombatta in Hungary, further consolidating Russian crude flows in the region, including to a European Union candidate country.

This initiative comes as geopolitical tensions persist and several European states strengthen regulatory and logistical measures to reduce dependence on Russia. The stance of certain member states raises questions about the consistency of national strategies with commitments made at the EU level.