On July 8, 2020, the European Commission published its strategy on renewable hydrogen for an energy-neutral Europe.

Europe unveils its renewable hydrogen strategy

Europe has unveiled its hydrogen strategy, and at the same time officially launched the European Alliance for Renewable Hydrogen, involving business leaders, civil society, national ministers and the European Investment Bank.

The development of hydrogen is essential for Europe if it is to achieve its goal of carbon neutrality by 2050, if it is to contribute to the global effort to implement the Paris agreements, and if it is to strive for zero pollution.

In an energy system, hydrogen will enable the decarbonization of industry, transport, power generation and buildings throughout Europe. The strategy then unveils how to turn hydrogen’s potential into reality, through investment, regulation, market creation and research and development.

Publication details

The publication reveals a plan stretching from 2020 to 2050 and divided into three main periods:

- Between 2020 and 2024, the European Union will support the installation of at least 6GW of electrolysers across Europe, and the production of up to 1 million tonnes of renewable hydrogen. During this period, the emphasis will be on developing wind and solar energy, but this requires coordinated action between the public and private sectors on a European scale.

- Thereafter, by 2025 to 2030, hydrogen should become an intrinsic part of the European Union’s energy system, with at least 40GW of electrolysers and production of up to 10 million tonnes of renewable hydrogen.

- Finally, between 2030 and 2050, renewable hydrogen technologies should be mature and will be deployed on a large scale in all sectors that are difficult to decarbonize.

The Commission has pledged to make renewable hydrogen the cornerstone of its climate ambitions and a means of recovering from the coronavirus crisis.

“Most of the energy transfer will be focused on direct electrification, but in sectors like steel, cement, chemicals, air traffic, heavy transport, shipping, we need something else,” said Frans Timmermans, executive vice-president of the Commission, “Renewable hydrogen is the key to a strong, competitive, carbon-free European economy.”

“We are sending a clear signal to Member States, industry and the world that we are determined to transform our energy sector and support recovery through clean investment,” said Energy Commissioner Kadri Simson, who presented the plan with Mr Timmermans.

However, hydrogen production currently relies on fossil fuels, and the EU doesn’t seem to be setting a date for production to change…

At the same time, Brussels has announced its intention to develop blue hydrogen produced from fossil fuels. This strategy states that blue hydrogen will be supported during a so-called “transition phase”, although the date is not specified in official publications, as many details have yet to be worked out.

What will Europe do?

To target support on the cleanest technologies, the European Commission will be working to establish common standards, terminology and certification. They will be based on lifecycle carbon emissions, and anchored in existing climate and energy legislation.

Europe will also be proposing political and regulatory measures to create security for investors and facilitate the adoption of hydrogen. We need to promote the necessary infrastructure and logistics networks. But also to adapt infrastructure planning tools and support investment through the EU’s forthcoming recovery plan.

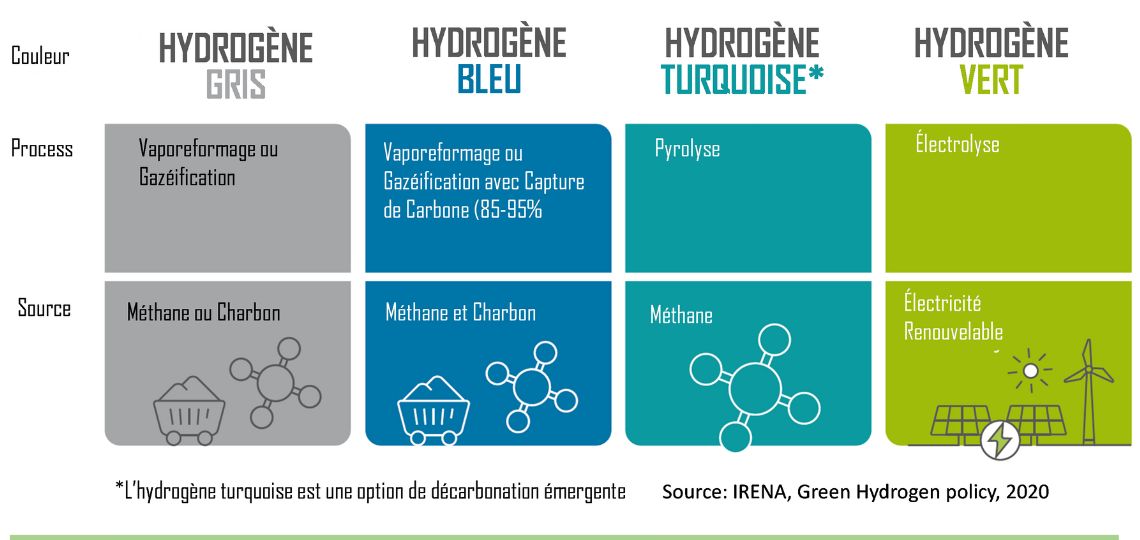

Hydrogen that’s not always clean

Hydrogen production can be problematic when it comes to meeting climate objectives such as those set out in the Paris Agreement.

Hydrogen generates no carbon emissions when burned, and can power manufacturing and transportation industries that are difficult to decarbonize. Existing pipelines can be upgraded to carry it.

Green hydrogen and blue hydrogen

However, while it is possible to produce hydrogen gas using renewable energy sources, over 95% of it is produced by high-emission fossil fuels. This is a process called steam methane reforming, or blue hydrogen.

This is how green hydrogen and blue hydrogen came into contact.

A coalition of utilities and renewable energy developers, including Enel, RWE, Ørsted and First Solar, is backing green hydrogen. This would open up a vast new market for cheap wind and solar power.

On the other hand, companies with natural gas assets, including Eni, Equinor and Exxon Mobil, have called for a technology-neutral strategy. They leave the door open to support for blue hydrogen.

However, it is not yet clear how much importance is attached to blue hydrogen by European institutions.