Renewable energies are at the heart of a new corporate acquisition. Norwegian company Scatec Solar acquires SN Power from Norwegian investment fund Norfund for $1.16 billion. The transaction is expected to be completed in the first half of 2021, subject to antitrust clearance. By acquiring this hydroelectricity developer, the company aims to expand its markets not only in Asia, but also in Africa, thus securing its place as world leader in the field.

Renewable energies at the heart of the transaction

Present in 14 countries with 450 employees, the company is set to acquire a 9.5 GW project portfolio in solar, hydro and wind power. According to Scatec Solar, the combined company’s median annual output should reach 4.1 TWh by early 2021. The company is thus diversifying its activities in Africa, where it had been producing only solar energy. The latter recently declared:

“This acquisition is an important part of Scatec Solar’s growth strategy, as we aim to become a major global player in solar, hydro, wind and storage.”

Market expansion in Asia and sub-Saharan Africa

Thanks to this transaction, the company will acquire sites in the Philippines, Laos and Uganda. However, the agreement does not include SN Power ‘s assets in Zambia and Panama, which will be sold to Nordfund.

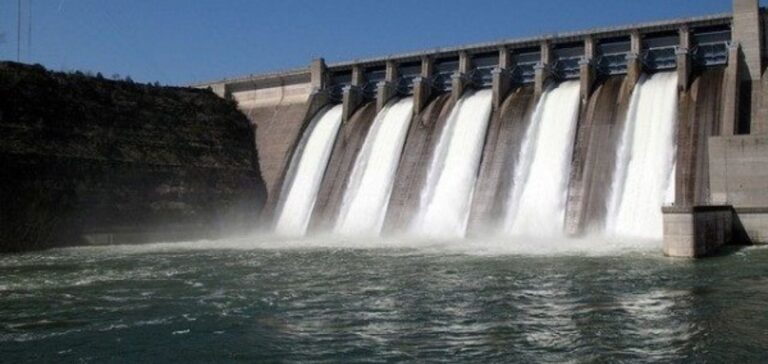

In particular, the new subsidiary is developing the 147 MW Ruzizi III hydroelectric project with Industrial Promotion Services. The aim is to generate electricity for the power grids of the Democratic Republic of Congo, Rwanda and Burundi.

An ecological partnership that creates jobs

According to Tellef Thorleifsson, Director of Nordfund for NS Energy, SN Power produces energy for 7 million people every year and avoids the emission of 3 million tonnes of carbon. This acquisition is an opportunity for Scatec Solar to consolidate its position as world leader in renewable energies.

“This investment has helped to create jobs, improve living conditions and avoid carbon emissions. By mobilizing private capital in SN Power, we can recycle significant funds for new investments. This demonstrates the effectiveness of using development aid to invest in clean energy in developing countries”, Tellef Thorleifsson.

Financing through the sale of shares

Scatec Solar raised $514.7 million in a private share sale. This sum will help repay the loan to purchase its new subsidiary SN Power. 966 million has already been paid to Norfund. The remaining $200 million will be paid in the form of a credit. Scatec Solar said:

“The acquisition is fully financed through a combination of cash available on Scatec Solar’s balance sheet, a $200 million seller’s bill, a $150 million term loan and $700 million in acquisition financing from Nordea Bank Danmark A/S, DNB ASA, BNP Paribas and Swadbank.”

The remaining cash will be used for growth capital and business needs.

A new hydropower joint venture

Scatec and Norfund have decided to join forces to operate hydroelectric projects in Africa, south of the Sahara. Under this alliance, Nordfund will have a 49% stake and Scatec Solar, which will be the operator, 51%.

Renewable energies to combat drought in Africa

Raymond Carlsen, President of Scatec Solar, wants to use the company’s solar experience, and combine it with SN Power’s hydroelectric project, to combat the region’s drought seasons. The use of floating solar panels could compensate for reduced dam production during these periods. He told Afrik21:

“Hydropower and solar photovoltaics are complementary technologies, opening up new project opportunities, such as floating solar on hydroelectric reservoirs. With this transaction, we see great potential in project expansion; as well as development in the growing markets of Southeast Asia and Sub-Saharan Africa.”

Scatec Solar therefore decided to invest in the future by expanding its area of expertise into the green energy sector.