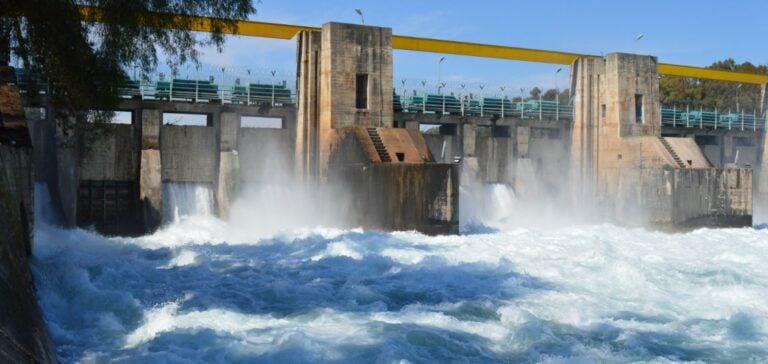

The Turkish Ministry of Treasury and Finance recently announced the privatization of the Seyhan 2 and Yüreğir hydroelectric plants, located in the Adana region. This initiative is part of Turkey’s privatization efforts aimed at increasing investment in the country’s energy sector. The tender will be conducted according to the “right of operation” method, thus granting investors operational control of these facilities for a defined period.

The plants in question are managed by the public company Elektrik Üretim A.Ş., and their management will be transferred to the highest bidder. Only legal entities and Joint Venture Groups (OGG) are permitted to participate, excluding individuals and private investment funds unless they are members of a Joint Venture Group with at least one legal entity.

Tender Conditions

Interested participants must meet several preliminary requirements. First, a signed “Confidentiality Agreement” must be submitted. Then, it is mandatory to acquire the Tender Specification and Presentation Document at a non-refundable cost of 60,000 TRY. A temporary guarantee of 8,000,000 TRY is also required to ensure participation. This process involves receiving bids in sealed envelopes, followed by a negotiation phase that could conclude with an auction.

Foreign investors may participate in this tender but must first verify the compatibility of their participation with the applicable regulations, including the law on direct foreign investments, property ownership regulations, and Turkey’s electricity market laws.

Financial Terms and Payment Modalities

Bids must be presented in Turkish lira (TRY), with flexibility for cash or installment payments. In the case of deferred payment, at least 35% of the bid amount must be paid immediately. The remainder can be settled in a maximum of 48 months, with a simple annual interest rate of 46%. If installment payment is chosen, a bank guarantee in the form of a letter of guarantee is required upon signing the contract to cover the deferred amount.

The project also benefits from exemptions from taxes, fees, and VAT, making it financially attractive for investors. The technical and legal aspects of the privatization are governed by Turkish privatization law and are supervised by the Privatization Administration of the ministry.

Procedures and Timeline

The tender closes on December 18, 2024. By that date, applicants must submit their bid and required documentation directly to the Privatization Administration headquarters in Ankara. To ensure the transparency of the process, applicants can choose to collect the documents in person or request their delivery electronically or by mail, under certain conditions.

The final results of the tender and the transfer of operating rights will be governed by Law No. 4046 on privatization practices, a framework that allows the Administration full control over the process and, if necessary, to postpone or cancel certain steps as circumstances dictate. Potential buyers are also advised to prepare for possible administrative checks and to verify their legal compliance.

The Seyhan 2 and Yüreğir plants represent a significant potential for investors looking to establish or strengthen their position in Turkey’s energy sector. Their privatization reflects a broader trend of delegating the management of strategic infrastructures to boost private investment in renewable energies.