Portugal states that the gas supply of Central European countries requires a close interconnection with the Iberian Peninsula. Lisbon believes that if this interconnection is impossible through France, then it should go through Italy.

A divisive project

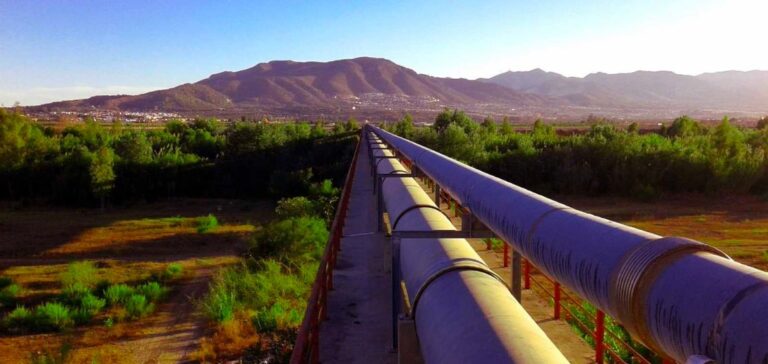

Portugal and Spain have significant gas import capacity through their LNG terminals. Thus, these terminals could supply Central Europe with additional pipeline connections. The two countries of the Iberian Peninsula take as an example the MidCat gas pipeline, crossing the Pyrenees between Spain and France.

However, French President Emmanuel Macron declared on September 5 that he was opposed to the MidCat pipeline project. It believes that the capacity of the two existing trans-Pyrenean gas pipelines is under-exploited. In addition, the French President recalls that gas flows were exported mainly to Spain.

A European issue according to Portugal

Portugal’s Minister of the Environment, Duarte Cordeiro, believes that this is a European issue and not a bilateral one. At the same time, he adds that it is crucial to find solutions. In addition, Lisbon is reportedly already in discussions with Rome about an alternative solution linking Italy across the Mediterranean.

Since August, German Chancellor Olaf Scholz has been lobbying for the construction of a gas pipeline from Portugal to Central Europe. Thus, the pipeline would cross Spain and France to supply Central Europe. The stated objective is to wean Europe off its energy dependence on Russia.

A project at a standstill

Portugal’s environment minister also says the Iberia project could be an alternative to Russian gas. Duarte Cordeiro believes that the development of renewable energy sources, with attractive prices, would also be an alternative. The Portuguese Minister of the Environment mentions in particular hydrogen, produced with renewable energy.

Launched in 2013, the MidCat project is expected to connect the Spanish gas network north of Barcelona to France. In addition, it aims to pump Algerian gas to northern Europe. However, due to cost and environmental concerns, the pipeline project has been on hold since 2019.