Oracle Power PLC, in collaboration with Oracle Energy Limited, has announced that it has received a no-objection certificate from the Sindh Environment Protection Agency (SEPA). It authorizes the construction of a 1.3gigawatt renewable energy production facility in Jhimpir, in Pakistan’s Sindh province. This certificate is based on the Initial Environmental Examination (IEE) report, an integral part of the Environmental and Social Impact Assessment (ESIA) report. It confirms the project’s compliance with strict regional environmental standards.

Project details and commitments

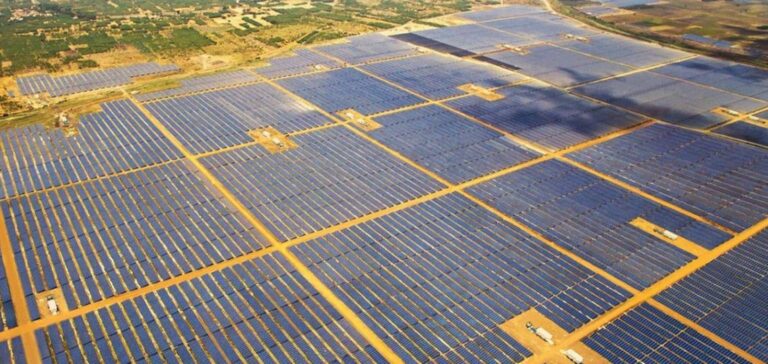

The project includes the installation of 800MW of photovoltaic solar panels and 500MW of wind power. They offer a combined capacity of 1300MW. As part of its commitments, Oracle Energy will ensure that it complies with national and provincial environmental quality standards. It will cover wastewater, drinking water, air emissions and noise levels. In addition, the company will implement a detailed environmental management plan. Part of the project will include tree planting to improve environmental conditions.

Future Benefits and Implications

SEPA’s approval not only facilitates potential financing for the project, but also underlines Oracle Energy’s commitment to sustainable development. Oracle CEO Naheed Memon stressed the importance of the project for the region’s energy supply. The project is strategically important for Pakistan. The country is seeking to diversify its energy sources and reduce its dependence on fossil fuels. SEPA’s confirmation of Oracle’s Jhimpir project represents a major step forward in Pakistan’s energy landscape. They promise not only cleaner energy, but also a step towards more sustainable development.