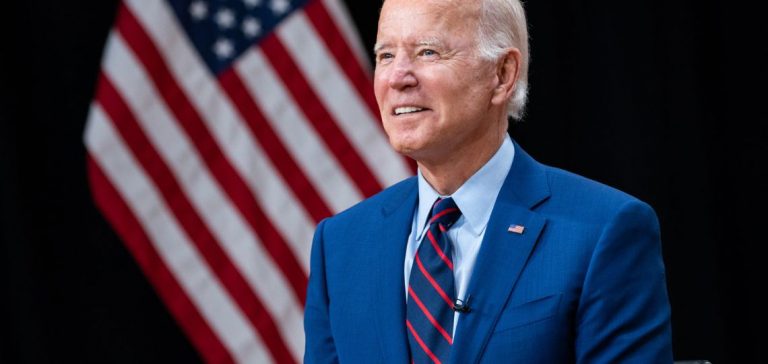

Oil prices saw a marked increase on Thursday in response to a statement by U.S. President Joe Biden, who indicated that discussions are underway with Israel regarding potential strikes on Iranian oil facilities. This announcement immediately sparked reactions in the markets, reflecting investors’ concerns about possible disruptions to oil supply.

By 15:10 GMT (17:10 in Paris), the price of Brent crude from the North Sea for December delivery rose by 3.83%, reaching $76.72 per barrel. Meanwhile, the West Texas Intermediate (WTI) crude for November delivery increased by 4.28%, settling at $73.10 per barrel. These gains come after both major oil benchmarks had already surged by over 5% earlier in the session.

Market Reactions and Investors’ Concerns

Biden’s statement had an immediate impact on oil prices, with investors fearing that strikes on Iranian production sites could affect global supply. Iran, which is among the top ten oil producers worldwide, holds the third-largest proven reserves behind Venezuela and Saudi Arabia. Ole Hvalbye, an analyst at Rystad Energy, commented to AFP that such strikes “could cause the market to lose two to three million barrels per day in the worst-case scenario.”

Escalation of Tensions in the Middle East

Recent military tensions between Israel, Iran, and Hezbollah have heightened fears of an uncontrollable escalation in the region. An Israeli strike on a Hezbollah rescue center in Beirut resulted in seven deaths early Thursday morning, following ground combat in southern Lebanon. Hezbollah stated that it repelled an Israeli advance attempt at the southern border, while the Israeli army reported conducting limited and localized operations.

Additionally, Houthi rebels in Yemen, supported by Iran, announced a drone attack in Israel, further exacerbating tensions. These developments have increased market concerns about the stability of oil supply, although some factors are mitigating these worries.

Factors Mitigating the Oil Market

Despite geopolitical tensions, oil prices remain relatively contained. The U.S. Energy Information Administration (EIA) reported an increase in crude stockpiles by 3.9 million barrels last week, surpassing analysts’ expectations of a 1.4 million-barrel rise. This stockpile buildup provides some flexibility to the markets, reassuring the global economy’s ability to absorb a potential supply shock.

Furthermore, Libya’s Minister of Oil announced in an interview with Bloomberg that Libya would resume oil production on Thursday, reintroducing hundreds of thousands of barrels per day to the markets. This resumption follows the resolution of a month-long political crisis in the country, contributing to stabilizing global supply.

Opep+ Decisions and Future Outlook

The Organization of the Petroleum Exporting Countries and their allies (Opep+) maintained its plan to increase production by an additional 2.2 million barrels starting in December during a meeting on Tuesday. Claudio Galimberti from Rystad Energy highlighted that “Opep+ still has unusually significant unused capacities” and could therefore produce even more if needed. This flexibility provides some assurance amid geopolitical uncertainties, although the situation remains volatile.

Oil markets are currently influenced by a combination of geopolitical tensions and economic factors that moderate the immediate impact of Biden’s statements. Market participants are closely monitoring developments in the Middle East and Opep+’s decisions to assess the future trajectory of oil prices.