Global nuclear electricity production is expected to reach 2,900 TWh in 2025, marking a historic record, according to the International Energy Agency (IEA). This growth reflects increasing demand, driven by sectors such as industry, air conditioning, and electric vehicles.

In 2023, more than 410 reactors were operational in 30 countries, generating 2,742 TWh of electricity. Continued growth is led by Asia, particularly China, which accounts for 25 of the 52 reactors whose construction has started since 2017. This dynamism contrasts with the setbacks observed in Europe and the United States, where high costs and delays undermine new projects.

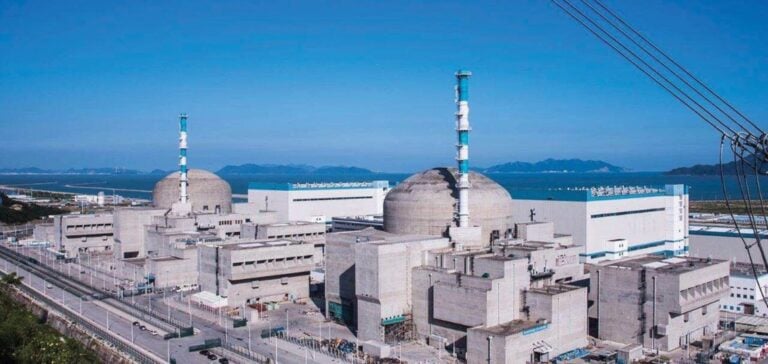

China’s Growing Dominance

China is set to surpass the United States and Europe to become the world’s leading nuclear power within five years. This rise illustrates a historic geographical shift in the nuclear industry, which had been dominated by the West since the 1970s.

In Europe, the share of nuclear in electricity production fell from 35% in the 1990s to less than 25% today. This decline is expected to continue, dropping below 15% within a decade. In the United States, similar challenges hinder the sector’s development.

Concentration of Enrichment Capacities

Global uranium enrichment supply relies on a limited number of actors. Four companies dominate the sector: China National Nuclear Corporation (CNNC), Rosatom (Russia), Urenco (Europe), and Orano (France). Together, they control 99% of enrichment capacities, with Rosatom alone representing 40%. This concentration poses a strategic risk, particularly in the context of growing geopolitical tensions.

Modular Reactors as a Future Solution

Technological advancements are paving the way for small modular reactors (SMRs), tailored to the specific needs of industrial sites or technology companies. These reactors, competitive compared to other renewable energy sources, are expected to play a key role in global electrification. Deployment is already underway in China, Europe, the United States, and Canada.

According to the IEA, global nuclear capacity could increase by 50% by 2050, reaching 650 GW, or even exceed 1,000 GW with ambitious government policies. Since 1971, nuclear energy has avoided 72 gigatons of CO2, strengthening both energy security and climate change mitigation.