The United Arab Emirates (UAE) is emerging as a market leader in International Renewable Energy Certificates (I-RECs).

In just a few years, the country has gone from being a minor issuer of solar certificates to a global market leader, alongside Brazil and China.

This rapid transformation is mainly fuelled by a significant increase in the nuclear generation of certificates.

Demand for I-RECs in the UAE is also growing, supported by a maturing market with a clearer framework, government initiatives to decarbonize the economy and increased adoption of corporate sustainability goals.

Adoption and development of the I-REC system in the UAE

The UAE adopted the I-REC system at the end of 2016.

The following year, the Dubai Carbon Centre of Excellence issued the first certificates representing the output of the 13 MW Mohammed bin Rashid Al Maktoum solar park.

Since then, the market has been divided into two separate systems: one in Dubai and a larger one in Abu Dhabi.

The Clean Energy Certificate (CEC) system is Abu Dhabi’s implementation of the I-REC standard.

Launched in August 2021, the system is managed by Emirates Water and Electricity Company (EWEC), acting as the sole registrar under the supervision of the Abu Dhabi Department of Energy, which is responsible for issuing the certificates.

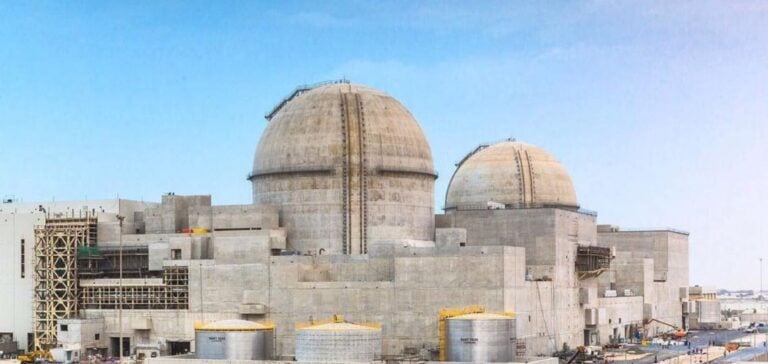

The predominant role of the Barakah nuclear power plant

The UAE is committed to a number of renewable energy initiatives, motivated by its goal of carbon neutrality by 2050 and its Energy Strategy 2050, which aims to increase the share of clean energy to 50% by 2050.

These targets, combined with significant government support and a well-established competitive procurement system, are driving the development and adoption of renewable energy at record prices. The Barakah nuclear power plant in Abu Dhabi dominates the offer, with a total capacity of 5.6 GW and an estimated output of 40 TWh/year when fully operational.

As for solar panels, five plants are registered in the I-REC system, two of which, Al Dhafra and Noor, are located in Abu Dhabi.

Corporate sustainability objectives as a driver of demand

Demand for I-RECs in the UAE has risen sharply over the past two years.

The commitment of companies and government entities to achieving carbon neutrality by 2050 is driving them to use instruments such as Clean Energy Certificates (CECs), particularly in the run-up to the United Nations Climate Change Conference (COP28), which the UAE will be hosting.

Demand comes mainly from corporate sustainability objectives in key sectors such as finance, tourism and manufacturing.

For example, Zero Two, an Abu Dhabi-based digital infrastructure development company, is making the largest single purchase of CEC in 2023, covering 7.3 TWh.

Market transparency and future challenges

Looking ahead, as the UAE continues to invest in renewable energy projects to meet its decarbonization targets, the availability of I-RECs is set to increase.

A steady supply of nuclear certificates will be complemented by a growing share of solar certificates.

However, a number of obstacles are limiting the wider adoption of I-RECs.

Lack of transparency, particularly regarding auction results and regulations, contrasts with other major I-REC markets and hinders participation.

In addition, geographical limitations on the retirement of Abu Dhabi certificates could lead to a glut in the emirate.

However, possible future market integration within the Gulf Cooperation Council could offer solutions.