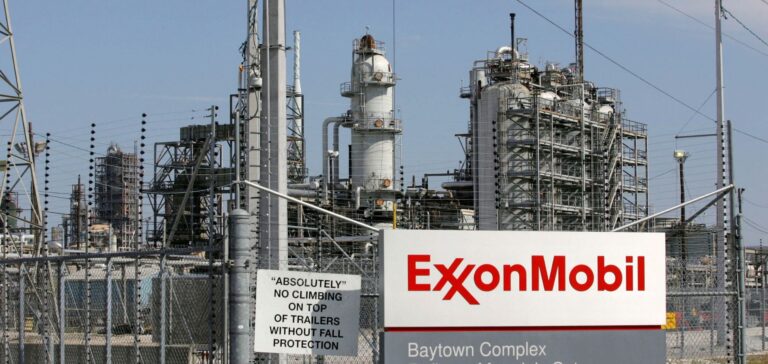

ExxonMobil is declaring force majeure on several oil export terminals in southern Nigeria in response to industrial action, the company’s Nigerian production unit told S&P Global Commodity Insights on April 17. The strikes halted crude shipments at four export terminals – Erha, Qua Iboe, Usan and Yoho, shipping and trading sources said, as industrial action by transport unions paralyzed Africa’s largest oil producer.

“This is due to industrial action by our internal workers’ union,” a company spokesperson said, adding that ExxonMobil would take all reasonable steps necessary to resolve the impasse quickly. “The safety of our people, our assets and our environment remains our top priority,” the spokesperson said.

Nigeria’s economy takes a hit

ExxonMobil exports about 300,000 b/d of crude and condensate from its Qua Iboe terminal in Akwa Ibom State, as well as natural gas. The closure of the company’s terminals represents a blow to Nigeria’s attempt to boost exports and increase revenues after a calamitous year in 2022, marked by theft and technical problems.

The confirmation of force majeure came as aviation workers’ strikes over wages and working conditions threatened to shut down the country’s largest airport. “A lot will depend on how quickly the dispute is resolved,” said one trader on market implications. “Exxon normally resolves industrial action fairly quickly and a delay of a day or two in loading cargoes will not be significant.” If it continues, however, “it will mean a significant tightening of the market,” the trader said.

Nigeria fails to fully exploit its resources

Platts, part of S&P Global Commodity Insights, last valued Qua Iboe crude at $86.10/bbl on April 14. ExxonMobil is reducing its interests in Nigeria’s onshore and shallow water assets in response to increased insecurity, sabotage and oil theft in recent years.

Nigeria has the capacity to produce about 2.2 million b/d of crude and condensate, but production has fallen to an average of 1.30 million b/d in 2022. Production has risen steadily since September, but fell back to 1.5 million b/d in March, according to data from the Nigerian Upstream Petroleum Regulatory Commission.