The military putsch in Niger revives the question of diversifying uranium supply sources. Orano (formerly Areva) still operates a uranium mine in the country. The diversification process, which is essential for nuclear power plants, has been underway for years.

Emmanuel Macron reassures on Orano despite instability in Niger

Over the weekend, French President Emmanuel Macron pledged that Paris would “not tolerate any attack against France and its interests” in the country, which has been shaken by political instability since a military putsch overthrew President Mohamed Bazoum last week.

Economically speaking, few French companies are present in Niger, apart from the Orano group (formerly Areva), which still operates a uranium mine in the north. The group, which specializes in the nuclear fuel cycle and employs some 900 people in the country – mainly local staff – said on Thursday that it was monitoring the situation very closely, but was reassuring.

“The current crisis has no short-term impact on Orano’s delivery capacity to France and its international customers”, the group’s management told AFP on Monday, putting its dependence on Niger into perspective “thanks to production and projects under development on (…) four continents”.

Niger: a key player in uranium supply for the EU and France

In 2021, Niger will account for 4.7% of the world’s natural uranium production, far behind Kazakhstan (45.2%), according to the Euratom Supply Agency (ESA).

In 2022, “Niger was the EU’s second-largest supplier of natural uranium, with a 25.38% share” contributing to the manufacture of fuel for some 103 reactors operating in 13 EU member countries, half of which are in France (56 reactors), Euratom told AFP on Monday.

In total, Kazakhstan, Niger and Canada supplied 74.19% of the EU’s natural uranium. Over the period 2005-2020, Niger was France’s third-largest supplier of natural uranium, accounting for 19% of its supplies, behind Kazakhstan and Australia and ahead of Uzbekistan, according to data from the Euratom Technical Committee.

Diversifying sources of uranium supply: France downplays its link with Niger.

However, for this mineral, Niger “is no longer the strategic partner of Paris as it may have been in the 1960s-70s”, commented Alain Antil, Director of the Sub-Saharan Africa Center at the French Institute of International Relations (IFRI), to AFP.

“The situation in Niger does not present any risk to France’s security of supply of natural uranium,” the French Ministry of Energy Transition told AFP, adding that French nuclear operator EDF was committed to diversifying its sources of supply.

Nuclear operator EDF “has been following a strategy of diversifying its supply portfolio for more than a decade”, turning “towards Central Asian countries such as Uzbekistan and Kazakhstan, and Australia”, points out Teva Meyer, a researcher specializing in civil nuclear power at the University of Haute Alsace in Mulhouse.

Ensuring diversification of uranium supplies in the EU

Reassuringly, the Minister of Foreign Affairs reported that supplies were “extremely diversified”. The diversification of nuclear materials is one of the long-standing and recurring recommendations of the Euratom Supply Agency.

“The political and economic events of 2021 and early 2022″, with in particular the war in Ukraine led by Russia”, a major uranium player, have in fact “underlined the relevance and urgency of ESA’s recommendations”, stressed the European agency in its 2021 report of August 2022. “Overall” in the EU, natural uranium supplies “are well diversified, but a number of utilities purchase their uranium from a single supplier”, according to the report.

Inventory management policy and diversity of uranium supply sources

In addition to this diversification policy, the French group EDF has implemented “an inventory management policy covering several years and is developing spent fuel recycling”, adds the ministry. “We have three years’ worth of enriched fuel on our territory (in France), so there’s no supply risk,” also stresses Nicolas Goldberg, energy expert at Colombus Consulting.

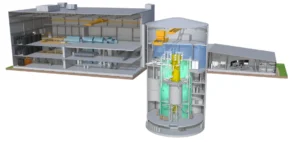

“Between the time uranium is mined and the time it is used as fuel in a power plant, it can take years, as there are many processing stages,” explains Teva Meyer.

For a reactor to use natural uranium, it has to be purified, converted and enriched.

According to Teva Meyer, “France and Europe also have strategic stocks of uranium at all stages of processing, equivalent to two years’ consumption”.