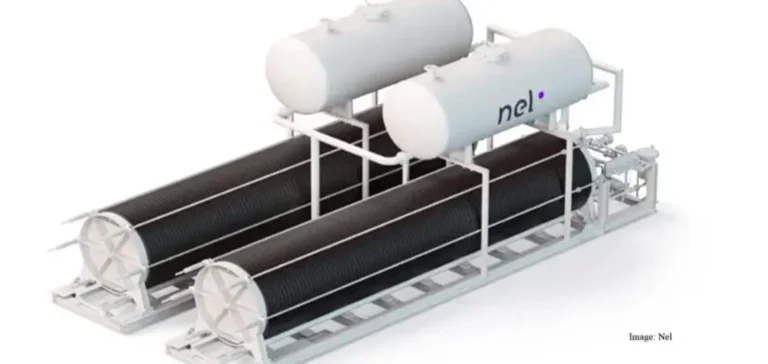

Hydrogen equipment manufacturer Nel ASA has announced a firm order exceeding $50mn (NOK562mn) for the supply of PEM electrolyser systems for two separate projects developed in Norway by Hydrogen Solutions AS (HYDS). The HyFuel and Kaupanes projects, each with a production capacity of 20 MW, will use Nel’s MC 500 containerised technology.

Two industrial projects funded by Enova

HyFuel is led by a consortium including HYDS, Sogn og Fjordane Energi AS and Fjord Base Holding AS. The unit will be installed at the offshore supply base in Florø. The project received NOK180mn ($16.88mn) in public funding from Enova, the Norwegian government agency responsible for energy transition.

The second project, Kaupanes, will be located in the industrial zone of Eigersund. It is co-owned by HYDS, Dalane Energi AS and Eigersund Næring og Havn KF. Enova allocated NOK206mn ($19.34mn) to support the initiative, reflecting the government’s interest in fostering local green hydrogen development.

A strategic order for Nel

According to Nel, this is the company’s second-largest contract to date by value, and its largest ever for PEM equipment. The systems will be manufactured at its automated plant in Wallingford, United States, with deliveries scheduled to begin in the second half of 2026 and commercial operations expected in early 2028.

Nel ASA President and Chief Executive Officer Håkon Volldal stated that the “strategic” order demonstrates the competitiveness of the company’s PEM platform for large-scale installations. He added that the deal is expected to positively impact the group’s financial performance by scaling up its service and maintenance operations in Europe.

HYDS expands its hydrogen footprint

HYDS, based in Leirvik, develops, owns and operates hydrogen production facilities powered by renewable energy. The company operates across the full value chain, from development and power sourcing to hydrogen distribution and related products.

With existing operational experience in the country, the company sees these projects as an opportunity to build a local green hydrogen market using proven expertise. HYDS Chief Executive Officer Frode Kirkedam described this new stage as an “important partnership” in the company’s growth in Norway and across the Nordic region.