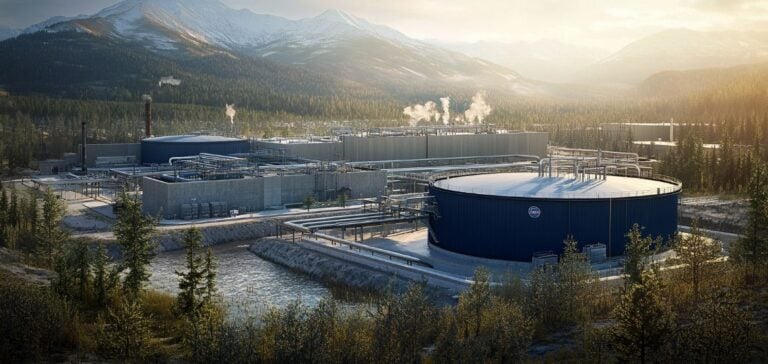

A long-term contract has been signed between Pine Cliff Energy and a private company to supply natural gas for an off-grid data center in Alberta. The agreement ensures the daily delivery of 3.2 to 4.8 million standard cubic feet (MMcf/d) of natural gas over an initial term of 25 years.

This data center, designed to operate independently of the provincial power grid, will be constructed and operated by the partner company. It will rely on Pine Cliff’s local infrastructure to ensure direct access to the natural gas required for its operations. The supply will be indexed to a 12-month rolling average of NYMEX prices, a contractual mechanism aimed at mitigating market price volatility.

Regulatory and Contractual Challenges Ahead

The project depends on several prerequisites before the natural gas supply can commence. These include completing construction, obtaining regulatory permits, and achieving operational validation of the site. Failure to meet these milestones could lead to the early termination of the contract.

This type of partnership reflects a pragmatic approach to addressing the growing energy demands of the technology sector. Energy autonomy is increasingly becoming a strategic lever for players seeking to secure their operations in environments where grid access can be complex.

An Energy Model Tailored to New Uses

The use of natural gas to power a data center illustrates the growing convergence of the energy and technology sectors. By leveraging available local resources, this project optimizes the use of existing infrastructure while providing long-term supply guarantees.

For companies, this approach offers tariff flexibility and cost predictability. The NYMEX-based pricing mechanism enhances the model’s attractiveness by ensuring stability amid energy market volatility.

Strategic Market Impacts

This agreement is set against a backdrop in which data centers play an increasingly critical role in digital economies. Energy choices are becoming a key variable, not only to meet immediate needs but also to anticipate regulatory changes and investor expectations.

In Alberta, dependence on fossil fuels remains a political and economic issue. This project highlights the tensions between technological development, energy imperatives, and environmental regulations. Strategic choices in such partnerships can influence the future of energy investments in the region.