NANO Nuclear Energy Inc. announced it has entered into securities purchase agreements with several institutional investors for a total of $400mn, through an oversubscribed private placement priced at the market under Nasdaq rules. The transaction, expected to close around October 10, will significantly strengthen the company’s financing capacity.

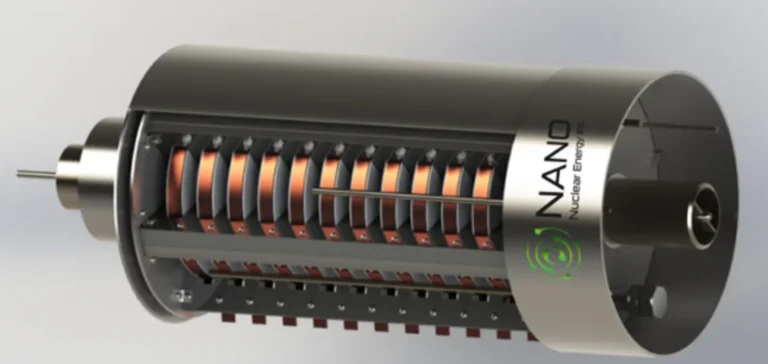

Main objective: KRONOS MMR™ development

The funds raised will primarily be allocated to the advancement of the KRONOS MMR™ (Micro Modular Reactor) nuclear microreactor programme, currently under development. The company also plans to use part of the resources for its other compact nuclear projects, related regulatory activities, and potential strategic acquisitions.

NANO Nuclear Energy expects its cash position to reach approximately $600mn upon closing of the transaction. This strengthened financial capacity is intended to support its ambition to contribute to the new generation of more modular nuclear technologies, potentially more flexible for energy networks.

Participation from major asset manager

The transaction was led by an initial investment from a prominent asset manager, joined by existing and new institutional investors. Titan Partners Group, a division of American Capital Partners, acted as the exclusive placement agent for the transaction.

The securities issued are not registered under the Securities Act of 1933 and may not be offered or sold in the United States without registration or an applicable exemption. NANO Nuclear has committed to filing a registration statement with the Securities and Exchange Commission (SEC) to enable resale of the shares within a compliant regulatory framework.

Strategic fundraising amid industry consolidation

The announcement comes as small-scale nuclear technologies are attracting increasing attention from industrial and financial players in a shifting global energy landscape. The company indicated that funds will also support general operations and other nuclear energy business lines.

No further details were disclosed regarding the identity of the lead asset manager or the specific terms applicable to the resale of the securities. The closing remains subject to customary conditions associated with this type of market transaction.