Northern Mozambique is experiencing an unprecedented escalation of jihadist violence, with seven attacks claimed by the Islamic State-affiliated group in late July in southern Cabo Delgado province. These raids caused the displacement of nearly 59,000 people around the town of Chiure, according to data collected by Doctors Without Borders (MSF) and confirmed by the United Nations (UN). This wave of displacement, the largest since February 2024, comes at a critical time as TotalEnergies prepares to resume its liquefied natural gas (LNG) megaproject, suspended since the deadly attack on Palma in March 2021.

A Calculated Insurgent Strategy to Destabilize the Region

Armed groups have modified their tactical approach by targeting less protected areas in the southern part of the province. Insurgents left their traditional bases near Macomia to exploit the weak security presence around Chiure, where they remained for ten days without encountering state forces according to Peter Bofin, senior analyst for the Armed Conflict Location & Event Data Project (ACLED). This offensive does not signify an abandonment of their northern positions but represents a deliberate attempt to stretch Mozambican and Rwandan forces across multiple fronts. Islamic State has intensified its propaganda campaign with comprehensive coverage of Mozambique in its weekly magazine Al-Naba, demonstrating coordination between military and media actions.

Mozambican security forces, supported by approximately 2,500 Rwandan soldiers deployed since July 2021, remain concentrated in northern districts to protect gas installations. Rwanda receives European Union funding of 20 million euros, with ongoing discussions to double this amount to 40 million euros despite controversies linked to Rwandan involvement in the Democratic Republic of Congo conflict. The monthly cost of this military mission exceeds 10 million US dollars, creating considerable financial pressure on the Mozambican government which temporarily suspended its monthly payments of 2 million dollars in August 2024.

Major Economic Impact on the African Gas Sector

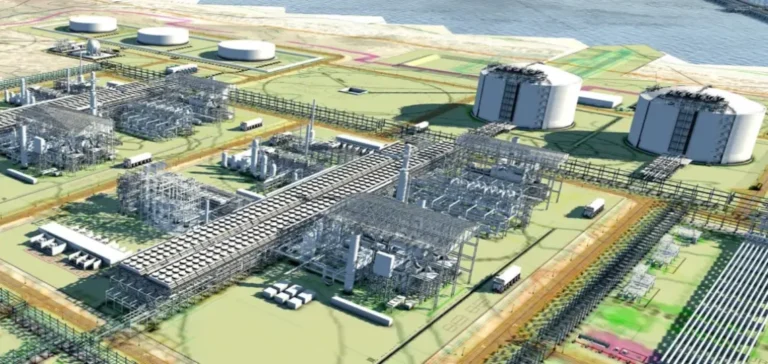

TotalEnergies’ Mozambique LNG project, valued at 20 billion dollars, was initially scheduled to enter production in 2024 but could now be delayed until 2030 according to Rystad Energy analysts. The infrastructure includes two liquefaction units with a combined capacity of 13.12 million tons per year, expandable to 43 million tons, which would position Mozambique as the world’s second-largest LNG producer. TotalEnergies holds a 26.5% operating stake in the project, alongside Mitsui & Co (20%), national company Empresa Nacional de Hidrocarbonetos (ENH) with 15%, and several Indian and Thai partners.

Project financing remains complex with a 5 billion dollar loan from the United States Export-Import Bank reapproved in March 2025, complementing the 14.9 billion dollars of senior financing already secured. Patrick Pouyanné, TotalEnergies CEO, confirmed in May 2025 at the World Gas Conference in Beijing that the group aims to resume work between June and August 2025. Construction costs have significantly increased due to global inflation and accumulated delays, questioning the initial profitability of the project in a context of increased competition from Qatar and the United States in the LNG market.

Humanitarian Crisis and Persistent Political Instability

The humanitarian situation in Cabo Delgado remains catastrophic with 1.3 million people displaced since the conflict began in 2017, including 710,000 still internally displaced. The 2025 humanitarian response plan requires 485 million dollars but is only 14 to 32% funded, limiting food distributions to once every two months and covering only 39% of beneficiaries’ caloric needs. Food insecurity affects 4.9 million people with 879,000 in critical or emergency situations according to the IPC (Integrated Food Security Phase Classification) classification.

Political instability worsened following the contested October 2024 elections where Daniel Chapo of the Mozambique Liberation Front (FRELIMO) was declared winner with 65-71% of votes against 24% for Venâncio Mondlane. Post-electoral demonstrations caused more than 300 deaths according to human rights organizations, with international condemnations from the European Union, United States, and Commonwealth regarding electoral irregularities. This political violence caused a new delay for the TotalEnergies project in January 2025, initially planned to restart by late 2024.

ACLED data indicates a 400% increase in attacks between 2023 and 2024, with more than 6,100 people killed since the beginning of the insurgency. Armed groups have adopted the use of improvised explosive devices (IEDs) and maintain approximately 300 to 400 active fighters, a significant reduction from the 2,500-3,000 estimated in 2021. The complexity of the security situation, combined with political and humanitarian challenges, raises fundamental questions about the long-term viability of gas investments in the region and Mozambique’s capacity to capitalize on its natural resources to stimulate national economic development.