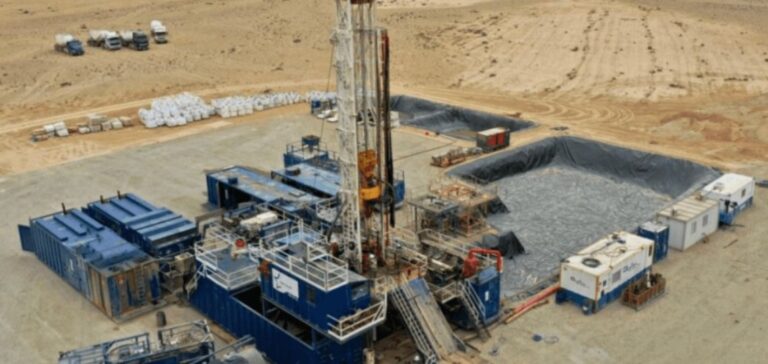

Predator Oil is continuing its gas exploration programme in Morocco, where the company has already drilled four wells on its Guercif licence. March 3, 2025, marks the start of drilling for the MOU-5 well, a strategic step in evaluating the gas potential of the site. Gas reserves in the region are estimated at 6 trillion cubic feet (TCF), and the success of this project could have a significant impact on the country’s energy supply.

Although previous drilling results have been mixed, Predator Oil is pinning its hopes on the MOU-5 well to more accurately assess the amount of exploitable gas. The company is focusing on shallow reservoirs, which would allow for rapid production if exploitable resources are discovered. This approach aims to optimise drilling costs, a crucial factor given the growing national and international demand for gas.

A strategic region for gas exploitation

The location of Guercif, near existing gas infrastructure, enhances the project’s appeal. If drilling proves successful, the proximity to transport and distribution networks will facilitate the rapid integration of extracted gas into the national energy system. Predator Oil is thus striving to maximise cost-efficiency while exploring the potential of the region.

Morocco, with its desire to reduce energy dependence, sees the exploitation of its gas resources as an opportunity to secure the stability of its gas supply. This exploration is part of a broader energy diversification strategy, in response to the closure of the Maghreb-Europe Gas Pipeline (GME) in 2021, which ended a partial gas supply.

A key issue for Morocco’s energy policy

The development of local gas resources has become a priority for Morocco, especially after the cessation of the GME. This situation has pushed the country to turn to domestic solutions to secure its gas supply. If the Guercif drilling proves successful, it will contribute to strengthening the country’s strategy to diversify its energy sources and reduce reliance on imports.

The exploration at Guercif is therefore part of a broader energy policy, where Moroccan authorities are seeking to fully exploit local resources to support long-term energy independence. The results of the drilling work, which is expected to last around 12 days, will be crucial for the future of the project.