METLEN Energy & Metals, a major player in energy and metals, has officially started trading its shares on the London Stock Exchange (LSE) on August 5, 2025. This step represents a strategic advancement in its development, following a voluntary share exchange offer that achieved an acceptance rate of over 90% among shareholders.

A dual listing to strengthen market access

METLEN’s presence on the London financial market is accompanied by a secondary listing on the Athens Stock Exchange (ASE). This operation provides the company with increased exposure to both institutional and private investors, with the goal of supporting its growth plan at a European and international scale. METLEN’s primary listing on the London Stock Exchange is denominated in euros, marking a first for this marketplace.

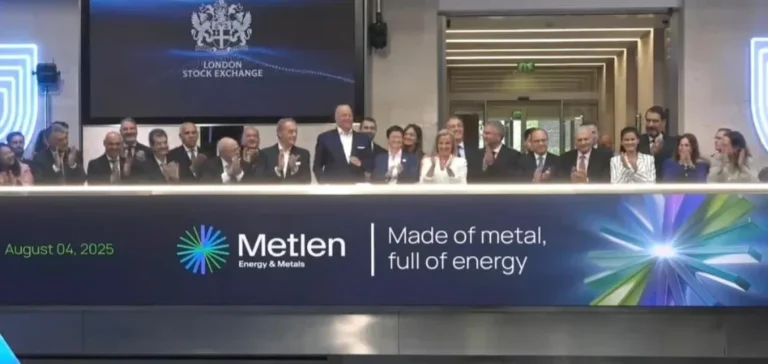

The company’s executives, led by Chief Executive Officer Evangelos Mytilineos, marked the launch of this listing with an official opening ceremony, symbolizing the group’s transformation into a dual-listed company.

International and legal advisory structure

The success of this operation is based on the involvement of several financial and legal players. Morgan Stanley & Co. International Plc and Citigroup Global Markets Limited acted as joint financial advisors and sponsors during the London Stock Exchange listing. In parallel, National Bank of Greece S.A. and Piraeus Bank provided support for the Athens listing and the voluntary share exchange offer.

On the legal front, Clifford Chance LLP acted as international counsel to the company, while the Bernitsas law firm supported METLEN with Greek regulatory matters. The British sponsors benefited from Latham & Watkins’ international legal expertise, while Karatzas & Partners focused on Greek regulatory matters. Finally, Papanikolopoulou & Partners served as advisor to the Greek banking partners.

Strengthened fiscal and accounting support

For this operation, METLEN also received advice from EY LLP on international tax issues. PricewaterhouseCoopers LLP acted as reporting accountant during the listing of the shares on the London Stock Exchange, ensuring compliance with the financial standards required by stock exchange authorities.

METLEN’s dual listing, backed by all these partners, aims to facilitate its growth in new markets and to enhance its visibility among investors. The operation takes place in a context of sector structuring for energy and metals, characterized by capital openings and an increase in cross-border initiatives. The strategic choices and support arrangements unveiled during this listing point to new challenges for governance and financing of companies in the sector.