Abu Dhabi Future Energy Company PJSC, known as Masdar, and China’s Silk Road Fund (SRF) have announced a strategic partnership aimed at co-investing in renewable energy projects in countries participating in the Belt and Road Initiative (BRI). This agreement, signed during COP29, foresees SRF investing a total of 20 billion RMB (approximately USD 2.8 billion) into projects developed or operated by Masdar.

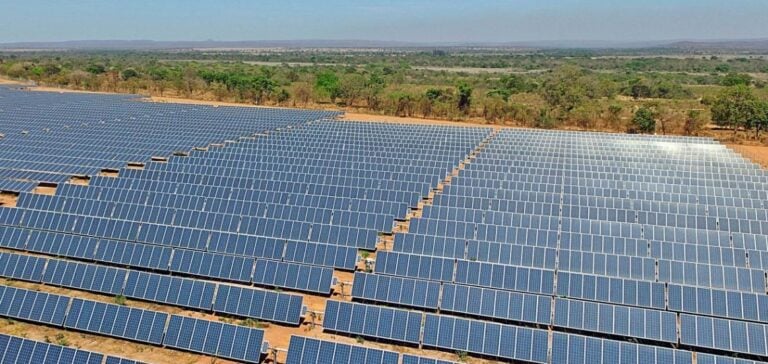

Masdar, a UAE-based clean energy leader, is already active in over 40 countries, particularly in Africa, Central Asia, and Southeast Asia. With an ambitious goal of reaching 100 GW of renewable energy capacity by 2030, the company is forging partnerships to support the global energy transition. This new collaboration with SRF focuses on emerging markets and regions in the global south.

A synergy for the energy transition

The Silk Road Fund, established in 2014 to support Belt and Road Initiative projects, has a renewable energy portfolio exceeding 7 GW, spread across BRI regions, including the Middle East, Africa, and Latin America. The agreement with Masdar strengthens its commitment to sustainable development while expanding its influence in the clean energy sector.

According to Mohamed Jameel Al Ramahi, CEO of Masdar, this partnership represents a significant step in international collaboration to promote renewable energy in developing markets. Zhu Jun, SRF Chairwoman, highlighted the importance of cooperation between the UAE and China under the BRI framework, calling the alliance a catalyst to boost investment in green infrastructure.

Shared objectives and future prospects

The two partners emphasized their shared vision for the global energy transition. Since its establishment in 2006, Masdar has positioned itself as a major player in renewable energy, pursuing ambitious projects in solar, wind, and green hydrogen. The company also aims to produce 1 million tons of green hydrogen annually by 2030.

On the Chinese side, the Silk Road Fund has made significant investments to support sustainable infrastructure projects and strengthen economic ties across BRI regions. This new agreement with Masdar marks another step toward what SRF refers to as the “Green Silk Road.”

This strategic partnership, combining technical expertise and financial capability, aims to accelerate efforts to address climate challenges and promote sustainable development on a global scale.