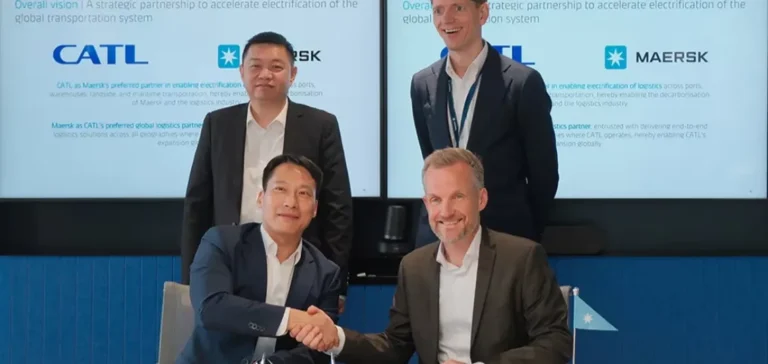

Danish logistics group A.P. Moller – Maersk has formalised a strategic memorandum of understanding with Contemporary Amperex Technology Co., Limited (CATL), a Chinese battery manufacturer, aimed at consolidating their cooperation in international logistics and supporting CATL’s global expansion. This new agreement appoints Maersk as CATL’s preferred global logistics partner and extends their existing collaboration to include integrated services such as ocean freight, air freight, project logistics, and warehousing.

Strengthening international logistics capabilities

For five years, the two companies have worked together in ocean transport and intermodal solutions. The signed agreement reinforces this engagement by planning tailored services to help CATL manage global supply chain resilience. In a complex geopolitical context and fragile supply chains, this alliance aims to ensure operational continuity and CATL’s competitiveness in key markets.

Maersk will leverage its international network and integrated logistics expertise to meet the specific demands of the markets targeted by CATL. The objective is to support CATL’s deployment and growth projects outside China by ensuring greater control over logistics flows and improving operational efficiency.

Deployment of logistics electrification solutions

In parallel, both companies have committed to collaborating on the electrification of logistics infrastructure, including maritime transport, ports, warehouses, and inland transport networks. CATL’s battery technologies will be integrated into projects led with Maersk, including electrical system design, energy management, and end-of-life battery recycling.

CATL will act as a preferred technology partner supporting Maersk’s emissions reduction strategy. Electrifying entire logistics segments will allow the testing of new operational models aligned with long-term carbon neutrality goals.

Strategic alignment on energy transition

Maersk is targeting full carbon neutrality by 2040, while CATL plans to reach neutrality in its core operations by 2025 and across its battery production chain by 2035. The partnership aims to capitalise on the convergence of these objectives to propose scalable industrial solutions for the wider sector.

Leaders from both groups have highlighted the importance of this cooperation in establishing new standards in international energy logistics. The agreement comes amid rising investments in clean technologies, where strategic alliances are becoming key levers for differentiation in global markets.