LSB Industries, a leader in ammonia production, has announced a strategic partnership with Freeport Minerals Corp. to supply low-carbon ammonium nitrate (ANS) for its copper operations in the United States. This five-year agreement marks a first in the US market, where a large proportion of the carbon emissions associated with ammonia production will be captured and sequestered. According to Jakob Krummenacher, Vice President Clean Energy at LSB Industries, this contract represents a turning point in the way the industry perceives the value of low-carbon products. Although other producers have succeeded in capturing and sequestering carbon emissions in the ammonia production process, this partnership with Freeport Minerals shows genuine recognition of the added value of these practices.

Development of Low-Carbon Ammonia

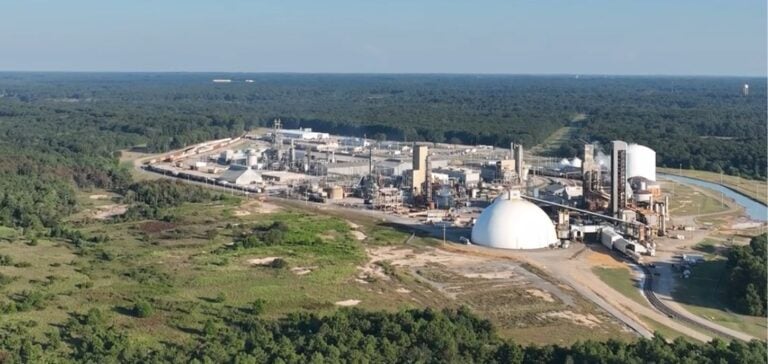

Production of this low-carbon ammonium nitrate will come from LSB’s facility in El Dorado, Arkansas, where, in partnership with Lapis Energy, the company plans to produce low-carbon ammonia using carbon capture and permanent sequestration. This installation will be capable of capturing 50% of on-site emissions, with an emissions reduction of around 30% for the SLA produced. Deliveries of low-carbon ANS are scheduled to start on January 1, 2025, with a gradual ramp-up in contract volume based on Environmental Protection Agency approval and contract terms.

Market Impact and Sustainability

This agreement sends a strong signal to the market about the value of low-carbon products. Used in copper mining, this low-carbon footprint ammonium nitrate will not only help reduce Freeport Minerals’ carbon emissions, but also help the company meet its sustainability targets. Krummenacher explains that low-carbon ammonia could be adopted in all sectors using ammonia as a raw material, such as nitric acid production and its downstream products. Chemical companies with sustainability objectives and purchasing renewable energy will have increasing incentives to introduce low-carbon ammonia into their processes.

Importance of Certification and Future Prospects

Although certification of hydrogen and its low-carbon derivatives is not yet fully ready in the USA, LSB Industries has designed its agreement to allocate a quantity of sequestered CO2 to each tonne of ANS sold. This allows buyers to know exactly how much carbon will be sequestered, providing transparency and assurance on emissions reduction. The agreement between LSB and Freeport Minerals illustrates the growing importance of sustainability in the chemical and mining industries. As companies seek to reduce their carbon footprint and meet stakeholder expectations, low-carbon products are becoming increasingly attractive and necessary to achieve these goals.