China’s power market reform, launched with the introduction of spot markets and some interprovincial trading, faces obstacles tied to regional disparities. These barriers hinder the transfer of renewable electricity from remote regions to fast-growing urban areas.

Internal trade barriers arise from economic differences between provinces. Local governments, with significant control over their electricity markets, often prioritize their own economic interests. This fragmentation complicates interprovincial cooperation, crucial for achieving a unified power market by 2030, with a key milestone set for 2025.

In northern and western China, where most renewable resources are located, energy demand and population density remain low. These regions, such as Gansu, Ningxia, and Inner Mongolia, concentrate the majority of solar and wind energy. Conversely, southern and eastern coastal provinces, densely populated and economically vibrant, have high energy demands.

However, the inability to effectively connect these two poles has led to a renewable energy curtailment rate exceeding 5% in the first half of 2024, according to a study by S&P Global Commodity Insights. This situation limits the expansion of new capacity, blocks project approvals, and constrains renewable energy development.

Trade barriers and local protectionism

Renewable energy-rich regions have attempted to attract heavy industries, such as aluminum production and solar panel manufacturing, by promising direct access to green electricity. However, supply chain costs and potential human rights concerns, particularly in Xinjiang, hinder these efforts.

Additionally, these regions must meet national renewable energy consumption targets, complicating massive electricity exports. Industrialized provinces remain reluctant to import large amounts of renewable energy, as it could weaken their local thermal power sector, essential to their regional economies.

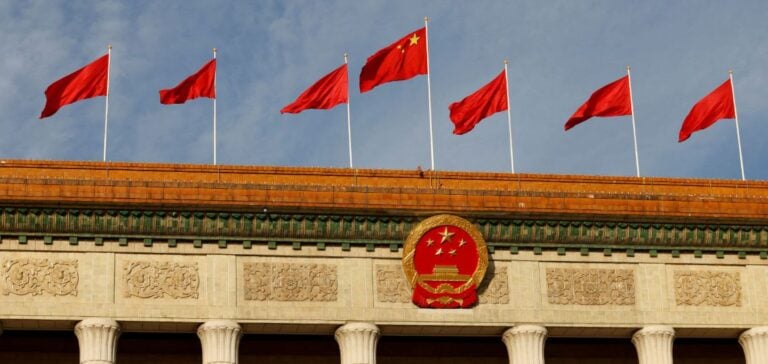

Central government initiatives

In 2023, the National Energy Administration issued a plan to reduce unfair practices in electricity trading. Despite these directives, little progress has been made. The China Electricity Council recently proposed allowing direct bilateral agreements between producers and consumers to bypass excessive local government involvement.

According to Song Hongkun, Deputy Director of the National Energy Administration, central intervention is needed to rectify protectionist practices. He advocates for a uniform electricity market to ensure better energy resource allocation and increased renewable energy integration.