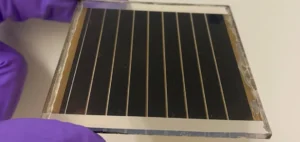

Lightsource bp has signed a contract with First Solar for the order of 4 GW of advanced thin film solar modules. The modules will be delivered between 2026 and 2028 and will power Lightsource bp projects in the United States. This order follows another signed in 2021 for up to 4.3 GW. Lightsource bp is poised to become one of the world’s largest users of First Solar’s ultra-low carbon solar technology.

Lightsource bp is committed to circularity and the reduction of greenhouse gas emissions

Lightsource bp is committed to recycling solar panels in all of its projects and using First Solar’s advanced recycling program to manage end-of-life modules. The solar module manufacturer is the first to have its product included in the EPEAT global register for sustainable electronics. Lightsource bp has also set scope 1, 2 and 3 greenhouse gas (GHG) emission reduction targets. First Solar, on the other hand, has set Scope 1 and 2 GHG emission reduction targets.

First Solar Invests in U.S. Manufacturing

First Solar is expanding its U.S. manufacturing capacity, with a third plant coming online in Ohio in the first half of 2023 and a fourth under construction in Alabama that is expected to come online by 2025. Both factories will produce the 7 module series ordered by Lightsource bp. The total cost of these First Solar investments in U.S. manufacturing is more than $4 billion. Annual manufacturing capacity is expected to reach 10.6 GW DC by 2026.

Thousands of Direct and Indirect U.S. Jobs Created by First Solar

First Solar estimates that its investments in Ohio and Alabama will add at least 850 new manufacturing jobs and more than 100 new R&D jobs, bringing its total direct U.S. employment to more than 3,000 people in four states by 2025. This makes the company one of the largest employers in the U.S. solar manufacturing sector.

Lightsource bp and First Solar Partner for Growth

Georges Antoun, First Solar’s chief commercial officer, said the new order from Lightsource bp is another significant commitment from the company and a reflection of its confidence in their technology. The relationship between the two companies is a partnership for growth, allowing each to grow through long-term price and supply commitments and state-of-the-art technology.