The Lagos State government announced on June 2 the launch of Africa’s largest clean cookstove initiative under a carbon credit mechanism aligned with the Paris Agreement. The initiative targets the distribution of 80 million improved cookstoves nationwide and could generate up to 1.2 billion tonnes of emission credits, usable in both domestic and international carbon markets.

Initial rollout of 6 million units

Titilayo Oshodi, Special Adviser to the Lagos State Governor, stated during the launch event that the first phase of the project would begin this month with the distribution of six million cookstoves. The project falls under Article 6.4 of the Paris Agreement, which allows entities to reduce emissions in one country and transfer the resulting credits to another country through regulated offset mechanisms.

This system enables governments or companies from industrialised countries to purchase these credits to offset a portion of their own emissions while financing projects in low-income countries. According to data from S&P Global Commodity Insights, credits generated from household devices, including improved cookstoves, are currently priced at just $3 per tonne of CO₂ equivalent.

A pressured market despite growing demand

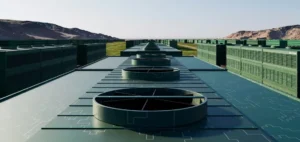

Improved cookstoves aim to replace traditional cooking methods involving charcoal, firewood or agricultural waste, which are widespread in sub-Saharan Africa. These practices not only generate high emissions but also contribute to numerous premature deaths due to indoor pollution. The distributed equipment uses cleaner fuels and offers improved energy efficiency.

However, similar programmes have recently faced criticism for overestimating their benefits, leading to excessive issuance of credits. This issue has contributed to a drop in the value of credits linked to such devices. Market observers note that the reliability of avoided emissions data remains a key issue for the mechanism’s credibility.

A closely watched initiative by the markets

This programme represents a large-scale first attempt by a Nigerian state to actively engage in global carbon markets through certified reduction mechanisms. The integration of this initiative into Nigeria’s domestic carbon market, still in its formative stages, could serve as a model for other African governments.

According to announced projections, if the project meets its targets, Nigeria could become one of the world’s leading suppliers of domestic and transferable carbon credits, depending on the evolution of verification methodologies and international market demand.