Harbour Energy, one of the UK’s leading oil companies, acquires Germany’s Wintershall Dea. A strategic maneuver to strengthen its presence in the North Sea. The British company is committed to stabilizing its production for the years 2024-2025, despite a fluctuating global energy context. In 2023, the company was able to offset a third of its production through the significant addition of new reserves. The announcement extends the previous production guidance, a sign of measured optimism and a well-considered strategy.

Strengthening North Sea Production

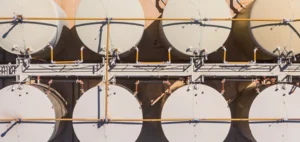

Increased production at the J-Area hub is testimony to the effectiveness of Harbour Energy’s proximity drilling strategies. The commissioning of the Talbot project in late 2024 and the upgrading of existing wells at the Judy Chalk field are key initiatives. The diversification of activities via the Greater Britannia and AELE hubs also underscores a desire to sustain production while exploring new development opportunities.

Challenge Management and Long-Term Vision

However, the company anticipates significant challenges, including increased maintenance and pipeline interruptions in 2024. These obstacles, while significant, are seen as necessary steps towards long-term optimization. Firm opposition to the UK’s Energy Profits Tax underlines the growing tension between industry players and government policies. Despite this, Harbour Energy is focused on completing the acquisition of Wintershall Dea, a crucial step towards successful diversification and strategic geographic expansion.

The acquisition of Wintershall Dea marks a strategic turning point for Harbour Energy, enabling it to diversify its activities beyond the UK borders. This merger aims to create a major independent player in the oil & gas sector, with a particular focus on safe, responsible, value-creating operations. Harbour Energy’s management, led by CEO Linda Cook, is optimistic about the company’s future, looking forward to continued expansion and a stronger presence in the global energy market.