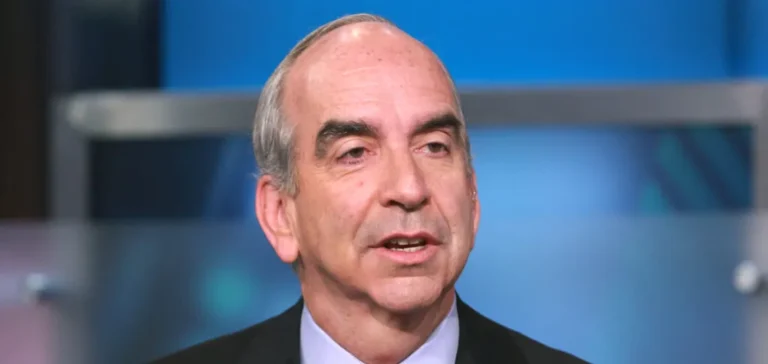

Chevron has formalised the arrival of John B. Hess to its board of directors, a decision that follows his departure from the position of Chief Executive Officer of Hess Corporation. John B. Hess, aged seventy-one, led Hess Corporation from 1995 to 2025, steering the company’s transition towards a globally focused independent exploration and production entity. His appointment aims to strengthen Chevron’s ability to navigate major developments in the international energy sector.

A career marked by transformation in the oil sector

John B. Hess’s career is marked by responsibilities within leading institutions in the sector and by major transformation initiatives. He served as chairman of the board of Hess Corporation from 1995 to 2013, initiating a strategic overhaul that repositioned the company among the main players in exploration and production. John B. Hess has also served on the advisory board of the United States Department of Energy, within the Quadrennial Review Task Force, and chaired the board of the American Petroleum Institute.

An international network of influence

John B. Hess sits on the board of directors of Goldman Sachs, at the management of the Center for Strategic and International Studies, as well as within the Business Council, the Trilateral Commission, and the Council on Foreign Relations. His involvement extends to the cultural and hospital spheres, with mandates at the board of the Lincoln Center for the Performing Arts, the New York Philharmonic, and Mount Sinai Hospital.

Expertise from leading universities

A graduate of Harvard College and holding an MBA from Harvard Business School, John B. Hess remains closely connected to these institutions as a member of the Harvard Business School’s Board of Dean’s Advisors and former chairman of the school’s fundraising campaign. The arrival of this experienced executive comes as part of a dynamic of strengthened governance and openness to the global challenges of the sector.

Chevron is now drawing on broader expertise to support its strategic decisions on an international scale, as market changes continue to influence the trajectory of global energy groups.