While Iran maintains that its nuclear program has never been intended for military purposes, recent precise data from the International Atomic Energy Agency (IAEA) reveal uranium enrichment levels inconsistent with the civilian needs claimed by Tehran. According to these reports, IAEA inspectors have repeatedly confirmed the presence of uranium enriched up to 83.7%, significantly surpassing the commonly accepted limits for medical or energy applications. Iran, however, insists these elevated levels result from occasional technical errors. Such claims have consistently been met with skepticism by technical experts and international intelligence agencies, who find repeated explanations implausible.

Strategic Leap from 60% to 90%

Uranium enrichment becomes technically less challenging as enrichment levels rise—a fact corroborated by leading scientific institutions, including Harvard University’s Belfer Center for Science and International Affairs and the Washington Institute. Initial enrichment from natural uranium to 20% requires thousands of centrifuges operating simultaneously for 12 to 18 months, due to the complexity and energy-intensive nature of isotopic separation at lower enrichment levels. However, beyond the 20% threshold—classified internationally as Highly Enriched Uranium (HEU)—the process progressively simplifies, especially beyond the critical threshold of 60%.

Advanced centrifuges, such as the IR-6 models deployed by Iran at Natanz and Fordow, can swiftly elevate uranium from 60% to the 90% weapons-grade required for nuclear arms within mere weeks. According to detailed analyses from the Washington Institute, Iran could feasibly produce sufficient 90%-enriched uranium for a nuclear weapon within less than a month, starting from its existing 60%-enriched stockpile. This extremely short timeframe fundamentally challenges Iran’s official claims of voluntarily limiting its enrichment below military thresholds.

Iran currently holds 408.6 kg of 60%-enriched uranium—equivalent to 604 kg of uranium hexafluoride (UF₆)—enough to produce several nuclear weapons in a very short period. Experts indicate it would only take between 7 to 23 days to convert this stockpile into weapons-grade uranium.

Nuclear Archive Revelations

In January 2018, Mossad, supported by prior intelligence from Saudi Arabian agencies, executed a clandestine operation in Tehran that led to the seizure of over 100,000 documents detailing Iran’s nuclear program, known as Project AMAD. This operation occurred in a warehouse located in southern Tehran, uncovering detailed plans for miniaturized nuclear warheads intended for ballistic missiles and explosive testing results at the Parchin site. Subsequently validated by Western intelligence agencies, these documents clearly demonstrated Iran’s technological capability to design a functional nuclear warhead even at that time.

Israeli Prime Minister at the time, Benjamin Netanyahu, publicly presented these archives in April 2018, declaring them incontrovertible proof of Tehran’s concealed military intentions. This revelation significantly influenced the U.S. decision to withdraw from the Iran nuclear agreement (Joint Comprehensive Plan of Action, JCPOA), adding a political dimension to this technically complex issue. The IAEA publicly acknowledged the strategic importance of these documents, indirectly confirming their authenticity and operational value.

International Consensus and Strategic Ambiguity

In light of these compelling findings, intelligence agencies from the United States, Israel, Saudi Arabia, and France agree that Iran has likely secretly reached a nuclear capability equivalent or close to a rudimentary weapon since late 2024 or early 2025. Reports suggest this warhead, though likely not officially tested to avoid immediate international backlash, is operational and stored securely. This deliberate ambiguity allowed Iran, until recently, to avoid stricter sanctions and direct military action from the international community.

Israel’s recent decision to directly target Iranian nuclear sites is thus closely linked to these technical and strategic insights, rather than purely political or regional motivations. By officially maintaining a 60% enrichment ceiling, Iran has strategically retained diplomatic negotiating space while preserving nearly immediate nuclear breakout capability. This dual strategy precisely explains Israel’s proactive stance.

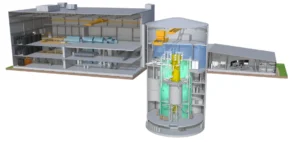

Before the recent conflict, Iran had installed 14,689 advanced centrifuges, primarily IR-2m, IR-4, and IR-6 models, mostly located in secure facilities at Natanz and Fordow. The IR-6 cascades at Fordow, positioned deep underground, are directly linked to a potential military breakout phase. These capabilities greatly narrow diplomatic options and inevitably call for international military cooperation in this crisis.

Following a week of military escalation between Israel and Iran, the numbers—408 kg of uranium at 60%, breakout potential within three weeks, and thousands of operational IR-6 centrifuges—underscore the immediate nuclear threat. This context reframes Israel’s military intervention, seen by its allies not as an isolated initiative, but as an urgent response to an acknowledged yet previously unaddressed threat.

SOURCES

-

(1) isis-online.org :

https://isis-online.org/uploads/isis-reports/documents/Analysis_of_May_2025_IAEA_Iran_Verification_Report_FINAL.pdf

-

(2) thebulletin.org :

https://thebulletin.org/wp-content/uploads/2025/06/Bulletin_Nuclear_Consortium_PGulf.pdf

-

(3) sgs.princeton.edu :

https://sgs.princeton.edu/sites/default/files/2023-04/uranium-enrichment-princeton.pdf

-

(4) Wikipedia :

https://fr.wikipedia.org/wiki/Usine_d%27enrichissement_d%27uranium_de_Fordo

-

(5) isis-online.org :

https://isis-online.org/uploads/isis-reports/documents/Iran_60%25_HEU_Update.pdf

-

(6) iranwatch.org :

https://iranwatch.org/library/wp-content/uploads/2015/05/Centrifuge_Capacity.pdf