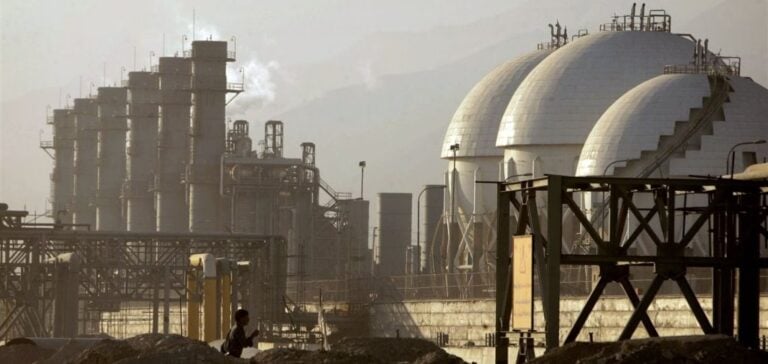

Iran is preparing to elect a new president, with two candidates with radically different visions for the future of the country’s energy industry. Masoud Pezeshkian, former Minister of Health, defends a strategy of economic openness and attracting foreign investment, while Saeed Jalili, former nuclear regulator, advocates a policy of self-sufficiency and economic resilience. This election will determine Iran’s energy trajectory for years to come.

Pezeshkian’s Pro-Investment strategy

Masoud Pezeshkian proposes resuming nuclear negotiations under the Joint Comprehensive Plan of Action (JCPOA) to lift economic sanctions and attract foreign investment. According to Pezeshkian, Iran needs $250 billion in annual investment to modernize and increase the capacity of its oil industry. He believes that international cooperation is essential to achieve these goals.

Energy expert Hamid Hosseini maintains that Pezeshkian firmly believes in the importance of international interaction to revive the Iranian economy. Lifting sanctions would not only boost oil exports, but also improve the country’s overall economic situation by attracting the foreign capital needed to develop its energy infrastructure.

Jalili’s conservative approach

Saeed Jalili, for his part, is a fervent advocate of economic self-sufficiency. He proposes to build new domestic refineries to increase the added value of Iranian petroleum products. Jalili favors the use of internal financial resources to develop the upstream sector and increase oil production without relying on foreign investment.

Jalili is also known for wanting to strengthen relations with countries like Russia and China, and to reduce Iran’s dependence on US dollar transactions. Its strategy is based on increased resistance to international sanctions and maximum exploitation of internal resources to maintain and increase oil production.

Implications for the Energy Market

The election of either Pezeshkian or Jalili will have significant repercussions on the Iranian and global energy markets. Under Raisi’s presidency, Iran managed to increase its oil production despite sanctions, reaching 3.17 million barrels per day in May 2024. Nevertheless, the Iranian economy remains fragile, with high inflation and renewed US sanctions.

Pezeshkian’s vision for lifting sanctions and attracting foreign investment could stabilize and boost the Iranian economy. On the other hand, Jalili’s strategy of increasing self-sufficiency could limit opportunities for foreign investment, but would guarantee a degree of economic independence.

Economic outlook

Whoever wins the election, Iran will have to overcome many challenges to achieve its energy goals. The country will have to navigate between the need to lift sanctions to attract investment and the desire to maintain a degree of economic independence.

Iran’s energy policy will play a crucial role in the country’s economic future. With some of the world’s largest oil reserves, decisions taken in Tehran will have global repercussions. Investors and analysts will be watching developments closely, as they will influence not only the Iranian economy but also the dynamics of the international oil market.