France and Germany take distinct approaches to reducing the carbon footprint of their industries, reveals an analysis by McKinsey and La Fabrique de l’Industrie.

The report shows that the direct emissions of French industry, or “scope 1” emissions, are significantly higher than those of Germany.

In 2021, France emitted 380 grams of CO2 per euro of industrial added value, compared with 290 grams for Germany.

This difference is attributed to the sectoral structure of the two economies.

French industry is heavily concentrated in carbon-intensive sectors such as metallurgy, chemicals and refining, while Germany is more focused on lower-emission manufacturing industries such as automobiles.

On the other hand, an analysis of emissions linked to the energy consumed by industry, or “scope 2”, shows that France enjoys a notable lead.

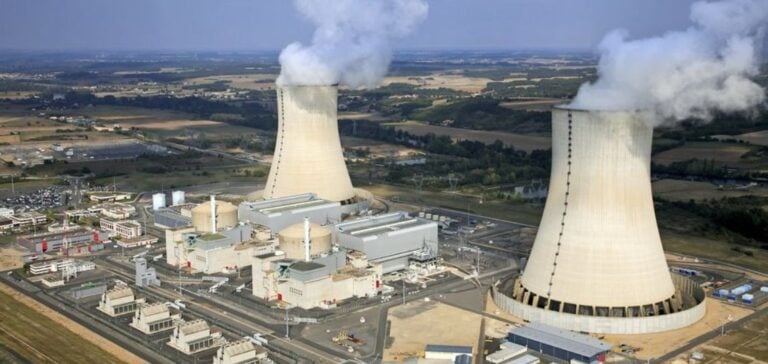

The massive use of nuclear power in France significantly reduces the carbon intensity of its industrial processes.

On average, electricity produced in France emits six times less CO2 than that produced in Germany, which is still heavily dependent on coal.

This factor enables France to partially offset its higher direct emissions.

When Scopes 1 and 2 emissions are added together, the emissions levels of the two countries become comparable: 371 grams of CO2 per euro of value added for France versus 359 grams for Germany.

Adaptation Capacities and Regional Strategies

To meet the challenges of reducing industrial emissions, France and Germany need to step up their efforts in terms of infrastructure and investment.

The study highlights the importance of developing solutions on a regional scale.

For example, projects such as the heat highway in Lille or the “D’artagnan” infrastructure in Dunkirk aim to capture, transport and store the CO2 generated by local industries.

To be effective, these initiatives require inter-regional cooperation and substantial investment.

Industrialists, however, remain wary of the costs and volatility of the energy market.

The price of electricity in France, offered at 70 euros per megawatt-hour by EDF for long-term contracts, is perceived as a barrier to the large-scale electrification of industrial processes.

Investment decisions are therefore highly dependent on the predictability of energy costs and possible tax incentives.

Workforce training and international competition

Another crucial issue is the availability of skilled professionals to support the industrial transition.

France is facing a shortage of talent in the technical and engineering fields needed to implement advanced emission reduction solutions.

This lack of skills is a major obstacle to companies wishing to modernize their facilities.

Global competition adds another layer of complexity.

With the rise of China in international markets and lower production costs outside Europe, French and German industries are under pressure to maintain their competitiveness while committing to emission reduction strategies.

The automotive and chemical sectors, in particular, are feeling this tension between the urgency of the energy transition and the reality of costs.

Finally, the study underlines that public policy coordination and government support are essential to overcoming these challenges.

Aligning industrial and energy strategies with emission reduction targets could help to better manage the economic and social impacts of this transition.