The UK government, through the Department for Energy Security and Net Zero (DESNZ), has granted Eni development consent (DCO) for the HyNet North West CO2 pipeline. This decision allows the construction, operation and maintenance of infrastructures dedicated to the transport of captured CO2, where Eni acts as transport and storage operator. This is the first Anglo-Welsh cross-border application for a Nationally Significant Infrastructure Project (NSIP) to be approved by the DESNZ.

The HyNet process and expectations

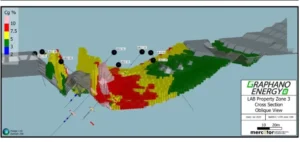

The DCO marks the end of an 18-month evaluation process following Eni’s submission of the application in October 2022. The HyNet North West project is thus entering its implementation phase, with a final investment decision (FID) expected in September 2024. The project aims to establish the world’s first regulated asset-based CCS company, transporting CO2 from capture facilities across the North West of England and North Wales to safe, permanent storage beneath the seabed of Liverpool Bay.

Eni’s commitment to decarbonization

Eni CEO Claudio Descalzi underlines the company’s commitment to decarbonization and energy transition in the UK. The HyNet project, together with the acquisition of Neptune Energy which gives Eni access to three additional CO2 storage licenses, strengthens Eni’s position in the supply of services to decarbonize industrial activities. Eni plans to store 4.5 million tonnes of CO2 per year in the first phase of the HyNet transport and storage system.

The HyNet project will help transform one of the country’s most energy-intensive industrial regions into one of the world’s leading low-carbon industrial clusters. It will play a crucial role in preserving local jobs, attracting investment and creating new jobs, while supporting the decarbonization of hard-to-lower industries.