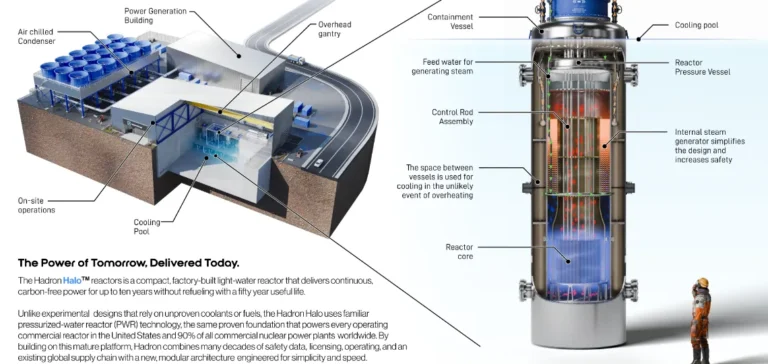

Hadron Energy, a company developing modular nuclear microreactors, has intensified its regulatory preparations as it nears its $1.2bn merger with special purpose acquisition company (SPAC) GigCapital7 Corp. The company has chosen to focus on light-water technology, which already benefits from a mature regulatory framework in the United States, overseen by the U.S. Nuclear Regulatory Commission (NRC), currently supervising 94 reactors of this type in operation.

An early-stage regulatory strategy

Since its founding, Hadron has pursued a structured relationship with the NRC, the civilian nuclear regulator. The company began participating in the commission’s public meetings in 2024 and has taken part in shaping policies related to advanced reactors. During a meeting in July 2025, Hadron was the only company to publicly support a more stringent safety framework for low-consequence microreactors—requirements its Halo MMR model is designed to meet.

In April 2025, the company submitted a Letter of Intent and a Regulatory Engagement Plan (REP), initiating a formal pre-application process with the NRC. The plan was subsequently updated to align with the regulator’s latest guidance. Hadron has submitted its Quality Assurance Program Description (QAPD) on schedule and plans to file a Topical Report on Principal Design Criteria (PDC) in the near future.

Maintaining targets despite government shutdown

The temporary federal government shutdown has not delayed Hadron’s strategy, as the company continues drafting technical reports and reinforcing its internal teams. It remains on track with its internal calendar, relying on a structured regulatory approach to support the development and commercial rollout of the Halo MMR.

Hadron has also initiated contact with the U.S. Department of Energy (DOE), aiming for potential collaboration under the Janus Project, a programme designed to prepare for the installation of microreactors on U.S. military bases. These discussions form part of a broader strategic alignment with federal agencies.

A key asset in the GigCapital7 merger

As the finalisation of the merger with GigCapital7 approaches, Hadron strengthens its investment appeal through advanced regulatory preparedness. The company is leveraging its technical and administrative groundwork to convince the market of its ability to industrialise its microreactors within a complex regulatory environment.