The energy transition is a major challenge for the 21st century, requiring innovative technologies to reduce greenhouse gas emissions and promote renewable energies. CryoCollect, founded in 2017, specializes in the design and engineering of processing, liquefaction and separation technologies for gases such as biomethane, carbon dioxide and hydrogen.

Pioneering Technology

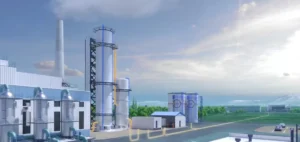

CryoCollect stands out for its advanced technologies for capturing, purifying and liquefying biogenic CO2. This CO2, integrated into the natural carbon cycle, replaces fossil CO2 in various industrial processes, notably in the food industry and the production of synthetic fuels. With over a dozen references on the market, CryoCollect’s CO2 capture technology is the most widespread in the sector.

Strategic support for CryoCollect

The investment of 4 million euros by GTT Strategic Ventures and Engie New Ventures testifies to the confidence of players in the energy sector in CryoCollect’s innovative capabilities. Philippe Berterottière, Chairman and CEO of GTT, emphasizes that this investment is in line with GTT’s commitment to innovation and the development of intelligent technologies contributing to a sustainable world. This investment is aimed at accelerating CryoCollect’s developments in the field of sustainable gas production.

Future prospects

The future of the energy transition depends on continuous innovation in gas processing and liquefaction. CryoCollect is extending its expertise to other sectors, such as industrial and on-board CO2 capture, and methane liquefaction for the transport of biomethane as a sustainable fuel. This technological development is crucial to reducing our carbon footprint and promoting the use of renewable gases. By developing innovative solutions for gas treatment, CryoCollect actively contributes to the energy transition and the reduction of environmental impact.