Greece is facing growing demand for liquefied natural gas (LNG) to offset an unexpected shortfall in renewable energy production.

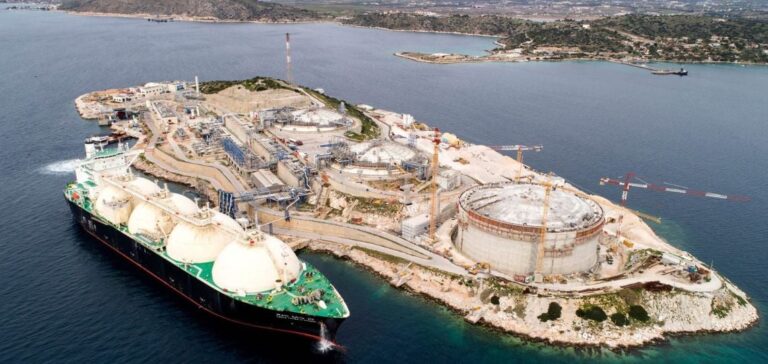

The vessel Palu LNG, carrying 463,000 MWh of LNG, is en route to the Revithoussa terminal.

This cargo, initially loaded at the Sabine Pass terminal, follows a stopover in Cartagena, Spain, where part of the cargo was unloaded.

The need for LNG is exacerbated by a significant reduction in wind and solar production, which has prompted Greece to increase its LNG imports.

Metlen, the company responsible for imports, has adjusted its plan in response to this situation, reintroducing a cargo that was initially cancelled.

This increase in imports illustrates Greece’s continuing dependence on LNG to stabilize its energy supply.

Effects on the gas market

This situation has led to a surge in gas prices in Greece, with the spot market recording increases of up to €48/MWh.

The context is marked by a relative scarcity of available cargoes in the Eastern Mediterranean, resulting in a price premium compared with other European markets.

DES East Med transactions, covering deliveries to Greece, Turkey and Croatia, reflect these tensions, with prices exceeding those observed in Northern Europe.

Market players have to cope with increased volatility, as fluctuations in renewable production exacerbate tensions on gas prices.

Growing demand has forced Greece to review its supply strategy, highlighting the challenges of energy balance in the Mediterranean.

Prospects and challenges for energy supply

While total LNG imports were down 44% on the previous year, this fuel remains essential for Greece.

The country has to juggle storage capacity constraints and unforeseen fluctuations in energy production, increasing its dependence on occasional LNG imports. Recent heat waves have amplified this situation, forcing the country to rely more heavily on LNG to meet its immediate needs.

The balance of the gas market in Greece remains fragile, with high sensitivity to variations in weather conditions and prices on international markets.

Players in the energy sector will have to continue adapting to this unstable context, where even small variations in production can have a disproportionate effect on prices.